Its always a painful thing to wait for the income tax refund, if we happen to invest more than what is required. Say for example, few of us would go for donation or charity which comes under 80G. Now a days 80G is not considered for Income Tax(IT) deductions in many of the Software service companies. Hence we have to claim tax refund for 80G related only when we file our IT returns for that financial year. So this becomes an excess money which would be returned by the IT department in the next financial year.

Checking The Refund Status

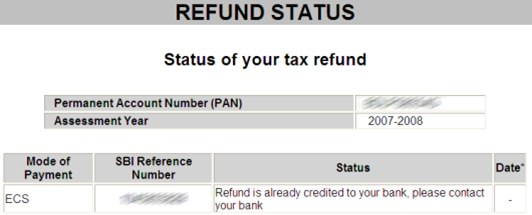

If you happened to pay more tax and waiting for the refund, Income Tax Departement of India has a website that provides the status of tax refunds. To know the status, point your web browser to https://tin.tin.nsdl.com/oltas/refundstatuslogin.html, enter your 10 digit PAN ID and select the financial year for which you want to the refuntd status.

Modes of Refund Payments

If you had opted for Electronic Clearing Service(ECS) mode of payment, your refund amount would be directly credited in your bank account details provided at the time of filing your IT returns. Otherwise you would receive a State Bank of India cheque.

I have not received my refund of the year 2008-09

I live in the USA but I have income in India and file my returns every year. For the AY 2008-2009 I filed my retuns and was to get a refund. I entered my Bank Info (State Bank of India) in the form, however I did not receive the refund for a long time. You site pointed me to the TIN status page. Thank you for taking the effort.

The curious situation is, the status says: Check returned as door was locked. Obviously, we do not live there any more and the filing I did included my USA address (since I am an NRI). I provided my Bank account for EFT, but they sent a check. Is that not wierd? The TIN site mentions, contacting the Assesing Officer. Why? Who? Where? How?

I am surprised that the EFT does guarantee the refunds to come to your account. Whoa.

Well if you do know some ways around it, please do post / mail me.

Thank you.

hiee

I have not yet received my refund for the assessment year 2007-08 for sum of Rs 3564/-

My PAN No: ABCPD4403D

My name is Lalitha Shettye. I have not yet received the refund for the Assessment year 2007-08.

Please let me know the status of my refund.

Please help me as soon as possb.

i have not received my incom tax return for 2009-10 and my Pan No. is AHx

my pan no. is AHZx, i have not received my Tax Refund yet for the financial year 2009-10

Hi,

i have submit my It returns for 2007-08 in delhi but still i have not gor my refund ,As i have also visit to TAX office but they told that my PAN card status need to be transfer to elhi account then it will be transfer….Is it correct statment given by TAX officer plz suggest or give me online link so that i can check my refund status…………its more than an year..

Hi,

When I tried using the above URL, after providing the required details and subitting, its giving “The page cannot be displayed”. I have tried changing all the required IE settings. Can anyone please help me.

Hi

My name is Venu. I have not yet received the refund for the Assessment year 2008-09.

Please let me know the status of my refund.

My PAN Number is ARSPSXXXXXX.

Thank you.

HELLO SIR, I AM JITENDER KUMAR, xxxxxxxxxxxxxxxxxxxxxxx. I HAVE FILED INCOME TAX RETURN FORM FOR THE ASSESSMENT YEAR 2008-09 & 2009-10, BUT I COULD NOT RECEIVE MY REFUND TILL NOW. PLS HELP ME. HOW MANY DAYS TAKEN IN THE REFUND OF INCOME TAX. PLS HELP ME.

Hi

I filed my 2006-07 Tax returns in Trichy TamilNadu. Where in my job/work profile lies in Bangalore. I did the same thing in 2004,05 as well. But 2006-07 i am expected to get some returns which i am not able to get. when ever i reach tax office they say file in banglore its thier resposbility. could please let me know the process and status of this.

thanks

sadha

Hi,

My Pan No. is AFUPVXXXXXX. Have not received refund for the assessment year 2008 – 09

Hi, I am Narinder Malhotra having PAN NO AMYPMXXXXE

I have done my filing for year 2008-09, but havent gotten my refund yet of 5k.

when i check the websites for refund status, it says has not been submitted by assessing officer,

what does this mean ? that my taxes werent filed, or just not in the sites records. because i have the stamped receipt of the agent that i have to get refund back.

Hi, I am also getting the message thet your assessing officer has not sent the return to refund banker. I am from delhi and i am checking status for year 2008-09. Has anyone else been able to recieve an update on this, if yes how. Kindly advise what to do!!

MY PAN NO. ADSPVxxxx. I HAVEN’T RECEIVED MY INCOME TAX REFUND OF PRVIOUS FINANCIAL YEAR 2008-09. PLEASE SUGGEST WHAT TO DO AND WHO IS THE CONCERNED PERSON FOR THAT SAME.

THANX N REGARD

AMIT VERMA

Dear Sirs,

I have filed my income tax returns on 20th August 2008 for the assessment year 2008-09. My PAN No. AAxxxx.

Still I have not received my refunds. Request you to kindly do the needful at the earliest.

Thanking you

Mercy Metilda

Dear Sir,

I have submitted my returns for 2008-09 on 28-Aug-2008 but still I have not received my refunds. Request you to kindly do the needful at the earliest.

Thanking you

Mercy Metialda

My PAN No is AADPNxxxxP

ASSESSMENT YEAR2009-2010

hOW TO EXPEDIE THE CLAIM

pLEASE HELP

my pan no.ACWPM5552H. NOT RECEIVED REFUND FOR THE ASSESSMENT YEAR 2008-09

My PAN no is AxxxxMxxxxN. I had to get a refund of Rs 8542(approx) in 2008-09 assessment year and Rs 497(approx) in 2007-08 assesment. I came to know from the TIN-NSDL website that they have sent me a refund cheque but that is returned to them undelivered as my house was locked. I opted for account credit(ECS). But they sent me a cheque as per the status in TIN-NSDL website.I gave my mobile number. They did not contact me. Simply they returned the cheque back to IT Deptt. Could you please tell me how I can get my refunds back at an early date? Thanks a lot in advance.

I have lost my income tax return paper.I want to Know about my previous income tax returns

my pan no.ACWPMxxxxxH. NOT RECEIVED REFUND OF IT FOR THE ASSESSMENT YEAR 2008-09

sir,i have no any I.T.ACKNOWLEDGEMENT FOR A.Y.2006-2007 & 2007-2008 HOW I CAN GET THE INFORMATION ABOUT THE RETURN FILED DETAILS (ACKNOLEDGEMENT NUMBER & DATE ) WHETHER IT HAS BEEN FILED OR NOT BY MY CHARTERED ACCOUNT. HOW I CAN FIND OUT WITH HIS HELP.

could u tell us my AY(2008-09)

my pan card AFKPTxxxP

please let us know the status of refund still not received money

I have to get refund of 10K+ due to excess tax deduction for FY2007-2008. when i enquired tambaram mudichur income tax office they are giving irresponsible answer everytime saying it will take 2 more months.

Hi Suganya,

Thanks a lot for your reply.I have opted for cheque.

Would cheques be send through normal post or registered post..any idea?

@Asha,

You cannot change the address that you gave when filing IT returns. Did you opt for ECS or cheque ? If its a cheque, then you can ask one of your colleagues to let you know once they receive the cheque through post. Else you don’t have to worry about this as the amount will be credited in your account directly.

I had to receive income tax refund of 25K. I checked on the link mentioned and it says Your assessing officer has not sent this refund to Refund Banker. My wife who has received refund 2 months back , has same status shown.How do i get my money back?

Hi,

Few queries on tax returns

I have filed tax return for 2008-09 and 2009-10 through an agent at Mysore who visits office.He has given the office address in my contact details.

1.I am shifting out of Mysore and need to change the address.How can I do this?

2.Can I give my permanent home address in another state or shoud I give Mysore local address only(tax returns filed at Mysore)

Please help as I need to get 25k returns from the govt.

Thanks.

Hi,

I haven’t got any refund from financial year 2007-08 which I had

filed in Bangalore. Now I am in Kolkata and dont have access to the agent through whom I had submitted by tax. I had opted for ECS in Bangalore branch.Till now I am getting the same message when I select any assesment year.

“Your assessing officer has not sent this refund to Refund Banker”.

How many months more will it take to get my refund as the agent had committed that I am suppossed to get the refund by last Oct 2008?

Hi

MY PAN number is ‘AJUxxxxx- assessment year – 2007-2008. I yet to get my refund. Could you please help me

regards

Ramalingam.M.C

You need to find your officer and pay up a percentage and then your refund will be processed soon

Hi … this was good info and can also please tell if there’s a way to file income tax return online too ? … it would be great if you can mark a copy of your response to chatduke@gmail.com …

thanks a lot for this article …

@Thandapani,

Check with your auditor or the person through whom you filed your returns.

My AY 2007-2008 refund status shows like this : Unable to credit refund as the account description provided by you is incorrect

and below note says: In case your electronic refund (ECS) is not credited to your account please contact your Assessing Officer and provide the correct MICR code and account number where credit is to be effected. The Assessing Officer will ask State Bank of India to send a fresh refund cheque to you.

I have got the MICR code for my bank account with me, but, I don’t know as to how to reach the Assessing Officer

Could you please help on this?

Many thanks,

Thandapani

Hi Suganya,

I haven’t got any refund from financial year 2006-07 and further.

I filed in Bangalore. I am getting the same message when I select any assesment year.

“Your assessing officer has not sent this refund to Refund Banker”

thanks

This is really very useful information. Most of them don’t know this URL. So, if they put this URL in end of Income-Tax Acknowledgement form. It is easy to track the tax-refund people.

Keep working ,great job!

ohh ok. Thank you Suganya. If you have the dates for other cities too, probably other people might find it important.

@Prakash,

The service has been extended to Kolkata only from September 30, 2007. If you had to get any refund for 2007 – 2008 financial year, hopefully you should be able to see the details in the site.

@Rochelle,

You have filed for the financial year 2008-2009 for which the refund would start only next year.So you need to wait till next year.Had the department guys started the process for your refund they would have updated the details in the site. I did file my papers for the 2006-2007 during june 2007 and I got my refund only in 2008 August for which I was able to check the status.

Hey, nice tips. I’ll buy a bottle of beer to the man from that forum who told me to go to your blog :)

I get this error message for every single year for all 5 years. I have received a checque 4 yrs ago and nothing after that. My returns are filed in Kolkata –

Your assessing officer has not sent this refund to Refund Banker.

this is a very usful URL..thanks a lot

Hi

I have done my filing for year 2008-09, but havent gotten my refund yet of 5k.

when i check the websites for refund status, it says has not been submitted by assessing officer,

what does this mean ? that my taxes werent filed, or just not in the sites records. because i have the stamped receipt of the agent that i have to get refund back.

I want to find out if I was eligible to get a refund check from 2007

@Mohan Kumar

Check if you need to get money returns from the government. If so,check with your auditor if he has filed your IT papers.

Check if you gave the correct assessment year

Note: If financial year is 2006-2007, then assessment year is 2007-2008

mY PAN NO IS AAQPM2843K 2006-2007 ASSESMENT REFUND IS NOT YET GETTING .i REQUIER THE PROCESS INFORMATIO

Pingback: Status Of Federal Tax Refund |

This is a very useful URL to bookmark. I will suggest to all of my friends.