It is the goal of this article to focus on what has happened as a result of the merge. What response did users have in the days following the announcement? Check ETH’s transaction history since switching to POS for any notable trends or outliers. In comparison, compare this to the behavior of users in the weeks and days before the event. Can you identify any major changes?

The Merge: What does it mean? Why should we merge?

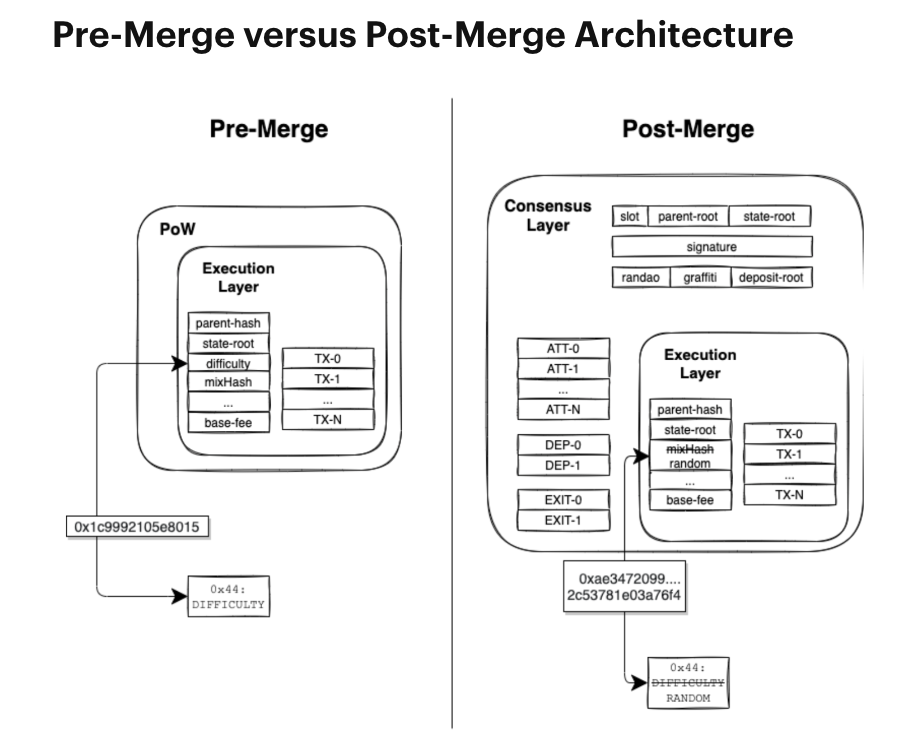

With the merge, Ethereum makes the transition from proof-of-work (PoW) to proof-of-stake (PoS). The proof-of-work method of consensus on the blockchain relies on the lockup of a staker’s Ethereum. Computing power is required to secure blockchain consensus. This is done by people (miners) who secure the network.

In order to solve the blockchain trilemma, Ethereum has worked on a variety of problems:

Security , decentralization and scalability The blockchain so far has compromised on at least one of these features. However, it is still helpful.

What are the benefits of the Merge?

The Merge allows for decentralization and security by requiring a minimal number of nodes and reducing the amount of work required to run nodes Compared to PoW, PoS requires 99% less energy Through scalability, it opens the possibility of sharding and 100k TPS in the future.

How does it works ?

- Ethereum is deposited into your account.

- Validators stake cryptocurrency with the protocol.

- You receive the staked ETH in the form of a liquid (sellable) wrapper.

- You will earn interest on that. If you want, you can trade in these liquid wrappers.

Ethereum Merge: When Did It Happen?

A long-awaited Merge occurred on Sept. 15 at 6:42:42 UTC at block 15,537,393, bringing together the Ethereum mainnet execution layer with Beacon Chain’s consensus layer at a Terminal Total Difficulty of 58,750,000,000,000,000,000,000, ending the use of a proof-of-work consensus system. With the Merge, the Ethereum network will have an energy efficiency of 99.95% and will be able to implement future scaling solutions, such as sharding.

In the tweet below, we can see that the Ethereum Merge has been completed.

And we finalized!

— vitalik.eth (@VitalikButerin) September 15, 2022

Happy merge all. This is a big moment for the Ethereum ecosystem. Everyone who helped make the merge happen should feel very proud today.

Approach

Based on the below analysis, we can see how the merger has responded in days following the Ethereum merger and how Ethereum has been evolving since its switch to POS. In order to achieve that, we followed the following steps:

- At the moment of Ethereum’s merger: Gas prices and swap volumes

- Check how the gas price spikes during the Ethereum Merge Announcement. As a result, we can observe users’ euphoria and congestion.

- In addition, we can see that DEX swap volumes increased significantly during the Ethereum Merge.

- Analyzing ETH transactions at the moment of switching to POS

- On Curve, post-merge users go bonkers for WETH-to-stETH swaps

- The top pairs swapped on Uniswap pre- and post-merge (USDC -> WETH)

- User behavior before and after the Ethereum Merge

- Take a look at how ETH transfers to CEX are slowing down after the merger

- As we move forward, we can look at how ETH transfers were made between the Top 10 central exchanges before and after the merger

- As a result of the merger, ETH sales are on the rise

Insights and Visualization

At the moment of Ethereum’s merge: Gas prices and swap volumes

It is already known that the Merge took place on Sept. 15 at 6:42:42 UTC at block 15,537,393. As we can see from the below graph, gas prices spiked up within minutes of the Ethereum merge. This shows the craziness of users during the merge. Within the next minute of the merge, gas prices were almost double what they were previously. There was a maximum average gas price (gwei) of 3.03K during minute 48 (post merge) and a minimum average gas price (gwei) of 369.07 during minute 37 (pre merge). If we compare the pre and post merger prices, the gas price spiked up almost 8 times.

From the below graph, we can see that swap volumes on DEXes spiked within minutes of the Ethereum merger. The volume of swaps on DEXs increased by almost 7 times within the minute after the merger. At minute 47 (post merger), there was a maximum swap volume of 22.39M, and at minute 39 (pre merge), there was a minimum swap volume of 325.39K. Out of the two periods, Period Post Merge contributes the most to total Swap Volume (80.3%). The total swap volume in minute 47 and minute 50 is higher than usual.

Analyzing ETH transactions at the moment of switching to POS

As we can see from the below graph, the users were impacted after the post merge merger when we looked at the swaps on curve. Upon looking at the WETH to StETH swaps on curve at the moment of the merge, we find that the spike occurred immediately after the merge. The swap volume of WETH to stETH suddenly increased from $80K to $6M in 44 minutes to 45 minutes on Sept 15th 2022. We can see later that it has increased the maximum swap volume of WETH->stETH to $8M by crazily in the 47th minute. Among the $35M total swap volume, we can see that the Top 2 Swap Pairs (WETH->stETH and stETH->WETH) contributed for nearly three quarters (76.13%). (WETH->KISHIBURNO) has a total swap volume of $7, and (WETH->stETH) has a total swap volume of $24M. In minute 47, an average swap volume of $10M was observed and in minute 41, a minimum swap volume of $6K was observed. Minutes 47 and 50 have a higher total swap volume than normal.

As we can see from the below graph, the users were impacted after the post merge merger when we looked at the swaps on Uniswap. The spike in WETH to USDC swaps on Uniswap occurred immediately after the merger, based on our analysis. The swap volume of USDC to WETH suddenly increased from $18K to $3M in 42 minutes to 43 minutes on Sept 15th 2022. We can see later that it has increased the maximum swap volume of USDC->WETH to $6M by crazily in the 47th minute. Among the $61M total swap volume, USDC->WETH Swap Pairs accounted for 31.64%, and Top 1% Swap Pairs accounted for 56.78%. There is a $0 total Swap Volume for WETH->DVI and a $19M total Swap Volume for USDC->WETH. A maximum swap volume of $12M was observed in minute 47, while a minimum swap volume of $292K was observed in minute 39. The total swap volume in minute 47 is higher than usual.

User behavior before and after the Ethereum Merge

As we can see here, ETH transfers to CEX have changed before and after the post-merge since Aug 1 2022. The previous day of the merge, a lot of ETH transfers to CEX were made. The following day, we can see the slowing of ETH transfers to CEX after the merge. There was a maximum amount of Ether Volume of 27.11M on September 14, 2022. In September 16, 2022, the total Eth Volume is lower than usual, and in September 14, 2022, it is higher than usual.

When we look at the ETH transfers to the top 10 centralized exchanges by users before and after the Ethereum Merge, we can see that about 10 CEXs increased transfers by users on Sept 14, 2022 (prior to the Merge). As a result of the merger, all 10 centralized exchanges have seen ETH transfers slowing down. A total of 194.39M Eth were traded between August 15, 2022 and September 22, 2022A maximum Ethereum volume of 19.97M was observed by all the top 10 CEXs on September 14, 2022. The total Eth volume in September 16 was lower than normal, and it was higher than normal in September 14, 2022. After the merger, 10 CEX’s Eth Volume trended downward.

According to the graph below, ETH sales have increased after the Merge. The maximum number of swaps with Eth Token In was 42.76K on September 15, 2022. There is an increasing trend in swaps with Eth Tokens.

Observations

- As we already known that the Merge took place on Sept. 15 at 6:42:42 UTC at block 15,537,393.

- According to the above analysis, gas prices spiked within minutes of Ethereum merging. Within a minute of the merger, gas prices were almost double what they were. Minute 48 (post merger) had the highest average gas price (GWEI) of 3.03K, while minute 37 (pre merge) had the lowest average gas price (GWEI).

- Based on the above analysis, the maximum swap volume at minute 47 (post merger) was 22.39M, and the minimum swap volume at minute 39 (pre merger) was 325.39K. The swap volume increased crazily after a few minutes of merging.

- Looking at WETH to StETH swaps on curve at the moment of the merger, we find that the spike followed immediately thereafter. On Sept 15th 2022, the swap volume of WETH to StETH increased suddenly from $80K to $6M in 44 minutes to 45 minutes. As we can see, the total swap volume is higher than usual in minutes 47 and 50.

- Based on our analysis, WETH to USDC swaps on Uniswap spiked immediately after the merger. The maximum swap volume was $12M in minute 47, while the minimum swap volume was $292K in minute 39. As compared to usual, the swap volume in minute 47 was higher.

- According to the CEX ETH transfers the day before the merge (Sept 14 2022), there were many ETH transfers to CEX. We can see the slowdown of ETH transfers to CEX after the merger the following day (September 15,2022).

- Additionally, we can see that the top 10 CEXs increased transfers by users on Sep 14, 2022 (prior to the merger). It has been observed that ETH transfers have slowed on all 10 centralized exchanges since the merger.

- Analysis shows that ETH sales have increased since the merger. The maximum number of swaps with Eth Token In was 42.76K on September 15, 2022. The number of swaps involving Eth Tokens is increasing.

- By looking at the increase in users and swap volume during these days of the merge, we can see that the Ethereum merge achieved its goal. The next big innovation for Ethereum will be sharding, which promises to speed up transactions and lower fees.

Reference Query

WITH cex_addys as (

SELECT

INITCAP(replace(TAG_NAME, 'user', '')) as cex_name,

address

FROM crosschain.core.address_tags

where tag_type ='cex'

),

trf_into_cex as (

SELECT

'Moved to CEX' as type,

date_trunc(day, block_timestamp) as date,

sum(amount) as eth_volume,

count(tx_hash) as transfers,

case when date >= '2022-09-15' then 'Post Merge' else 'Pre Merge' end as period

FROM ethereum.core.ez_eth_transfers trf

INNER JOIN cex_addys ON origin_to_address = address

WHERE block_timestamp >= '2022-08-01'

GROUP BY date

ORDER BY date desc, eth_volume desc

),

trf_out_of_cex as (

SELECT

'Removed From CEX' as type,

date_trunc(day, block_timestamp) as date,

-1 * sum(amount) as eth_volume,

count(tx_hash) as transfers

FROM ethereum.core.ez_eth_transfers trf

INNER JOIN cex_addys ON origin_from_address = address

WHERE block_timestamp >= '2022-08-01'

GROUP BY date

ORDER BY date desc, eth_volume desc

)

select * from trf_into_cex