With this dashboard, we aim to outline how the FTX Collapse has affected the Ethereum blockchain’s major liquidation system, AAVE.

AAVE

The Aave app is a decentralized finance (DeFi) application built on the Ethereum blockchain in which lenders and borrowers are the two key participants in the ecosystem. Lenders provide liquidity to the market (Lending Pools) to earn a passive income, while Borrowers are able to access the Lending Pools for the sole purpose of borrowing money by depositing over collateralized assets or through Flash Loans. According to defipulse.com, Aave is the world’s most successful defi application . To become the world’s top defi service is not an overnight accomplishment.

How Did The FTX Collapse?

In July 2021, FTX Exchange was the world’s third largest centralized cryptocurrency exchange. The company was founded in 2018 by MIT graduate Sam Bankman-Fried, a former Jane Street Capital global exchange-traded funds (ETFs) trader. As well as spot markets in over 300 cryptocurrency pairs, including BTC/USDT, ETH/USDT, XRP/USDT, and its native token FTT/USDT, it also included its native token, FTT/USDT. Three months ago, the exchange and the companies it surrounded began a steep decline. As a result of FTX’s sudden bankruptcy filing on November 11, 2022, Bankman-Fried resigned. Cryptocurrencies are likely to be affected for quite some time after FTX’s rapid decline and collapse, and broader markets may also suffer. Cryptocurrency’s volatility is exemplified again by FTX’s recent turn from potential savior to outright bailout candidate in a week.

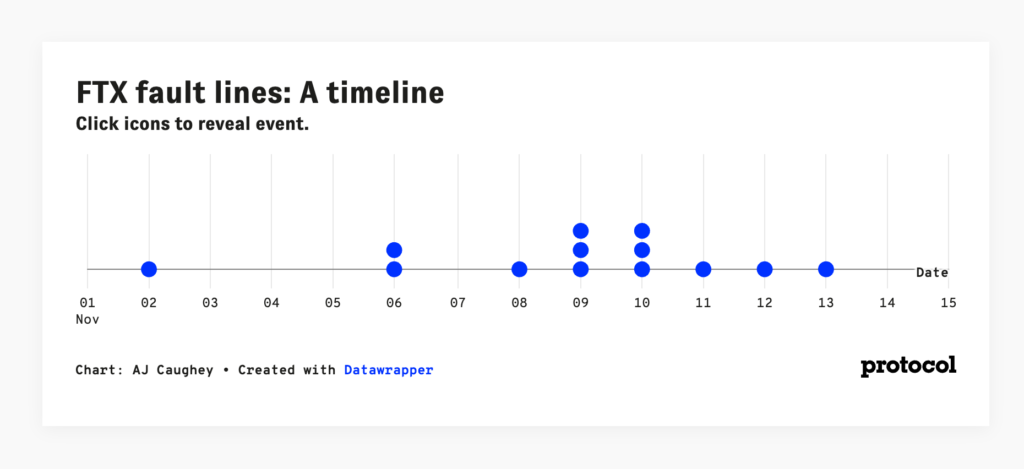

This week’s FTX news is summarized below.

- Nov. 2: The event begins. There are indications that FTX’s cash is largely made up of its own token, FTT, which is controlled centrally.

- On Nov. 6, Binance announced it would withdraw from FTT. An argument between Changpeng “CZ” Zhao and Sam Bankman-Fried, CEO of FTX, has broken out.

- A bailout offer is made by Binance on Nov. 8.

- Nov. 9: NVM! In response to Binance’s withdrawal, U.S. FTX is being investigated by regulators, according to reports. There is bad news spreading throughout the crypto industry as FTX’s bad luck spreads.

- November 10: Alameda Research falls. FTX scrambles for cash. The FTX US warns of a possible pause in trading.

- FTX files for bankruptcy on November 11 and Bankman-Fried steps down.

- The funds of a customer go missing on November 12.

- Involvement of Bahamian authorities on Nov. 13.

To get more detailed note about this please follow the link Read more….

Approach

This dashboard illustrates the impact of the FTX Collapse on Ethereum’s major liquidation system, AAVE. Specifically, we are looking at the liquidations data from Nov 2, 2022 onwards, according to collateral tokens. Based on different metrics on AAVE, we followed these steps:

- Liquidations of AAVE by collateral token during FTX collapse

- By collateral token, liquidation amount in USD

- Liquidator Transactions Used By Token

- Liquidators use borrowers according to tokens

- By using tokens, liquidators gained fees

- Tokens Used By Liquidators To Determine Liquidators

- By Token, the debt amount is to be covered in USD

- Top 10 AAVE liquidators during the collapse of FTX

- Liquidators by Fees Earned – Top 10

- In USD, top 10 liquidators by liquidation amount

- List of 10 Liquidators – Borrowers

- Events Participated by Top 10 Liquidators

- The AAVE Top 10 Borrowers At The Time Of The FTX Collapse

- Liquidated Amounts For The 10 Most Important Borrowers (USD)

- Borrowers who participated in the top 10 events

- Top 10 Borrowers by Collateral Tokens

- The top five borrowers are ranked based on their liquidated amounts by token

- AAVE, BAL, ENJ, MANA, etc… Top 5 Borrowers Liquidated Amount (USD) Tokens

Insights and Visualization

Observations

- Based on the above analysis, Liquidation Amount In USD By Collateral Token , we can see that the amount of liquidation by different collateral tokens has not been before November 2022. However, after this collapse of FTX, we are able to observe a maximum amount of liquidation by different collateral tokens. Particularly, we can see that the total Liquidation Amount was 86.54M between November 2, 2022 and December 8, 2022. USDC Collateral Tokens contributed over three quarters (78.46%) of the total liquidation amount. Furthermore, we can see that 63.48M was the maximum amount of liquidation on November 22, 2022. The USDC token is used to make this.

- When looking at the USDC collateral token transactions by liquidators by token, 43.61% accounted for USDC collateral token transactions. A total of 371 maximum transactions were also observed on November 22, 2022. This is a USDC product.

- WETH Collateral Tokens contribute 37.84% of all borrowers used by liquidators, and the most borrowers are from WETH Collateral Tokens.

- As for USDC Collateral Tokens, 84.45% of the total fee was contributed by USDC Collateral Tokens. In this case, the major fees were earned after the collapse of FTX.

- From the above analysis, we can also see that following the collapse of FTX, a number of liquidators have been appointed and the debt to cover the amount in USD has been raised as well.

- After the collapse of FTX in November 2022, many liquidators may have been forced to make these decisions. As a result, all metrics have been increased since the second week of November. Before November 2022, these are unlikely to be available.

- According to the above analysis, we can see the top 10 liquidators and the highest number of events they participated in was 180 (0x80d4230c0a68fc59cb264329d3a717fcaa472a13).

- Additionally, from the above analysis, we can see the top 10 Borrowers and if we consider the number of events they participated in, 97.22% of total Events were contributed by Borrower 0x57e04786e231af3343562c062e0d058f25dace9e. There are more than 97% of all events generated by just one user. The most events are generated by “0x57e04786e231af3343562c062e0d058f25dace9e”.

- Collateral Tokens WETH are the largest contributor (30%) to the total Collateral Token pool in the case of borrowers. Out of the 10 most borrowed tokens, WETH is borrowed three times.

Reference Query

1.

with liqudations as (

SELECT

TX_HASH,

block_timestamp,

liquidated_amount,

liquidated_amount_usd,

debt_to_cover_amount,

debt_to_cover_amount_usd,

liquidator,

borrower,

aave_version,

collateral_token_symbol,

debt_token_symbol,

LIQUIDATED_AMOUNT_USD - DEBT_TO_COVER_AMOUNT_USD as liqudation_fees_usd

FROM ethereum.aave.ez_liquidations

WHERE true --AAVE_VERSION = 'Aave V2'

and LIQUIDATED_AMOUNT_USD IS NOT NULL

and debt_token_price is not null

AND block_timestamp >= '2022-11-01'

)

SELECT

date_trunc(day, block_timestamp) as date,

collateral_token_symbol,

sum(liquidated_amount_usd) as liq_amt_usd,

sum(debt_to_cover_amount_usd) as debt_to_cover_usd,

sum(liqudation_fees_usd) as liq_fees_usd,

count(distinct borrower) as borrowers,

count(distinct liquidator) as liquidators,

count(distinct tx_hash) as txns

FROM liqudations

GROUP BY date, collateral_token_symbol

---------------------

2.

with liqudations as (

SELECT

TX_HASH,

block_timestamp,

liquidated_amount,

liquidated_amount_usd,

debt_to_cover_amount,

debt_to_cover_amount_usd,

liquidator,

borrower,

aave_version,

collateral_token_symbol,

debt_token_symbol,

LIQUIDATED_AMOUNT_USD - DEBT_TO_COVER_AMOUNT_USD as liqudation_fees_usd

FROM ethereum.aave.ez_liquidations

WHERE true --AAVE_VERSION = 'Aave V2'

and LIQUIDATED_AMOUNT_USD IS NOT NULL

and debt_token_price is not null

AND block_timestamp >= '2022-11-01'

)

SELECT

liquidator,

sum(liqudation_fees_usd) as fees_earned_usd,

count(distinct borrower) as borrowers,

sum(liquidated_amount_usd) as liq_amount_usd,

LISTAGG(distinct collateral_token_symbol, ',') as col_tokens,

count(tx_hash) as liq_events,

LISTAGG(distinct block_timestamp::date, ', ') as dates

FROM liqudations

GROUP BY liquidator

QUALIFY row_number() over( order by fees_earned_usd desc )<= 10

----------------

3.

with liqudations as (

SELECT

TX_HASH,

block_timestamp,

liquidated_amount,

liquidated_amount_usd,

debt_to_cover_amount,

debt_to_cover_amount_usd,

liquidator,

borrower,

aave_version,

collateral_token_symbol,

debt_token_symbol,

LIQUIDATED_AMOUNT_USD - DEBT_TO_COVER_AMOUNT_USD as liqudation_fees_usd

FROM ethereum.aave.ez_liquidations

WHERE true --AAVE_VERSION = 'Aave V2'

and LIQUIDATED_AMOUNT_USD IS NOT NULL

and debt_token_price is not null

AND block_timestamp >= '2022-11-01'

)

SELECT

borrower,

sum(liquidated_amount_usd) as liq_amount_usd,

LISTAGG(distinct collateral_token_symbol, ',') as col_tokens,

count(tx_hash) as liq_events,

LISTAGG(distinct block_timestamp::date, ', ') as dates

FROM liqudations

GROUP BY borrower

QUALIFY row_number() over( order by liq_amount_usd desc )<= 10