For the past few years every institutional investor is pondering the question Why in the World would you own Bonds when Bond markets offer ridiculously low yields. Here is a great write up from legendary investor Ray Dalio. Yields on Bonds, CDs, Savings accounts are lowest in the recent history and causing a lot of stress on the institutions that rely on them to generate cash flow. Pension funds, insurance companies, wealth funds and Savings accounts have a lot of money and sometime they are generating negative yields!

Here is a chart showing amount of money available in stable income securities

Here is another chart showing Money Supply M2 in the United States

Defi Offers High Yields

While many traditional low risk stable yield securities are struggling, Defi ecosystem is thriving with high yields. Here is a chart showing the latest interest rate offered by Aave for USDC depositors. It is around 5% as I write this post but it was hover above 15% during 2021 Defi Summer.

Defi offers sky high yields to investors compare to traditional securities but can a institutional investor pour in billions into Defi with a MetaMask Wallet extension or Ledger Nano Wallet? No it is not possible for Institutions to dive headfirst into Defi just like a retail investor. Institutions are managed & governed by a strict rules and regulations set by government as well as the money they manage on behalf of their customer is not insificant.

Aave Arc – The Gateway to Bridge TradeFi and DeFi

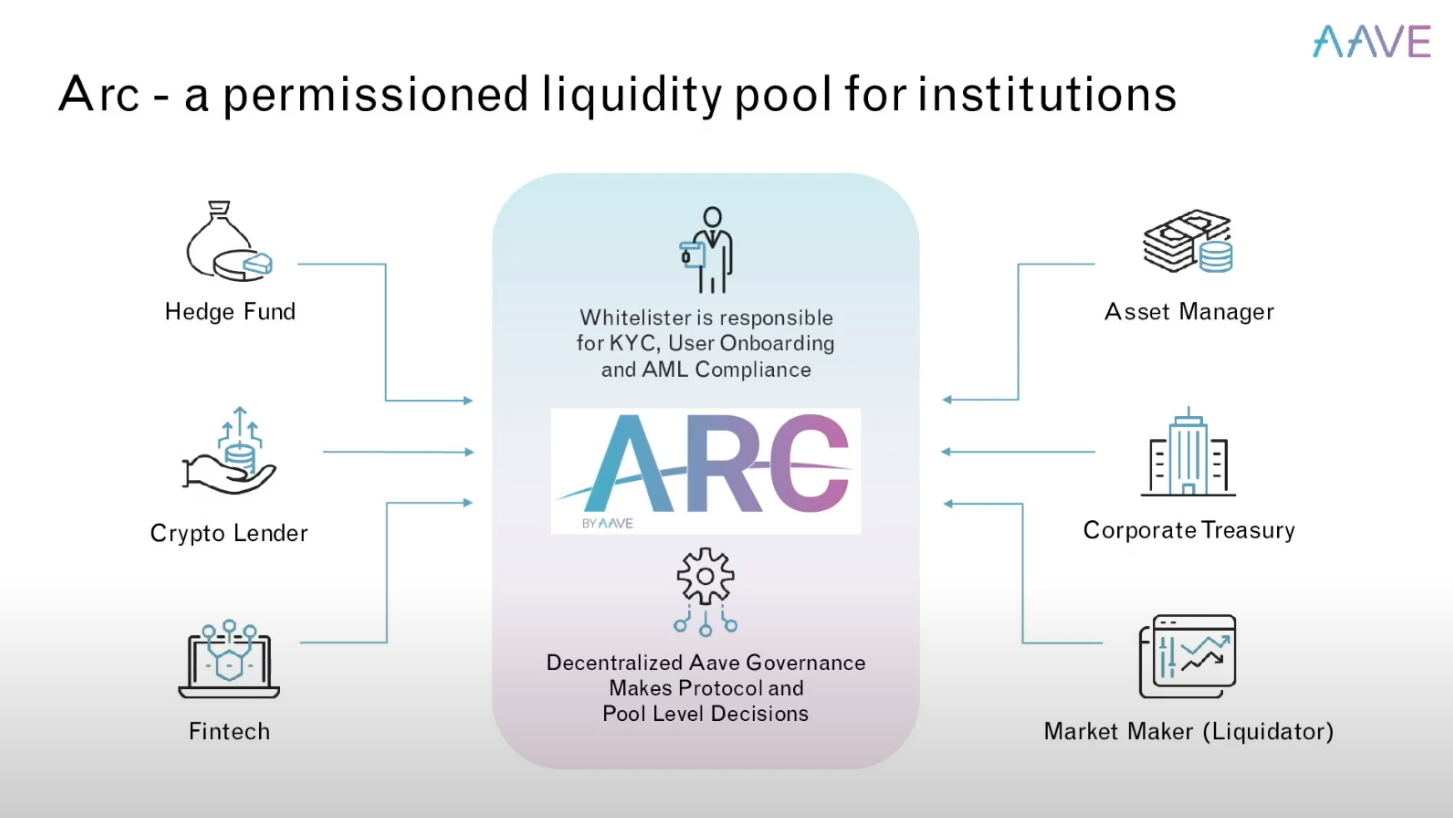

Aave Arc is the latest product offering from Aave for institutional investors to give them direct access to DeFi world. Aave Arc will help investors adhere to stringent regulatory requirements they generally operate in Traditional Finance yet still access DeFi. All participants Aave Arc ecosystem, both lending and borrowing sides, must pass know-your-customer/know-your-borrower checks. And Aave will deploy private Liquidity Pools for these investors so that they are managed separately from the existing public pools.

Here are the advantages of Aave Arc for Institutions

- KYC & KYB – Aave partnered with FireBlocks to make it easy to whitelist Aave Arc investors and help them with Know-Your-Cus

- Transaction & AML Risk Monitoring – Blockchains enable state of the art transaction monitoring tools to manage AML Risk.

- Scalable Liquidity – peer to peer architecture enables a transparent source of BTC, ETH and USDC liquidity.

- High Yield – instead of negative yields on TradeFi they get 4%+ yields in Defi.

- Proven Ecosystem – Aave smart contract is battle tested and proven resilience to wild swings in cryptocurrency price drops like 45% drop in a single day.

- Trust & Transparency – Aave smart contracts are open source, rigorously audited by security researchers and managing billions of assets.

- Access to Innovation – Several Family offices, hedge funds and banks gets access to all innovation in decentralized finance & blockchains.

- Simplified Liquidity – Aave Arc offers simplified set of liquidity pools and restricts liquidity pools to BTC, ETH, USDC and AAVE.

Aave Arc Yield

The current yields on public pools gives an indication how much it will be for institutional investors, but they will end up with different yields as the participation into Aave Arc is restricted. Behaviour of Institutions in investment is quite different to the way how public & retail investors operate. So we have to wait and see how this is going to pan out when launched. Also an Aave Arc investor can arbitrage between private lending pools and public lending pools. This may be an advantage for some institutions who would like bravely venture in to both private & public pools.

Another factor that could influence Aave yield once Aave Arc is launched is the amount of liquidity moving into Aave. If institutions provides a lot of liquidity into Aave in search of higher yields and the demand from borrowers does not increase significantly then the yields on deposits will drop.

Here is a chart showing correlation between Aave Utilization Rate & Deposit APYs

Who Else is Offering Services Similar to Aave Arc?

Compound Labs, one of the main competitors of Aave, launched Compound Treasury in June 2021 to open access to Compound Finance to Institutional Investors. The Compound Treasury works in a different way though it’s goals is to open its DeFi ecosystem to Institutional Investors.

With Compound Treasury, investors can invest US Dollars for a stable 4% yield and also abstract themselves from all the complexities of blockchain & decentralized finance. In order to pay 4% yield to the investors, the Compound Labs converts investor’s US Dollars into USDC and deploys them in to Compound Finance for yield farming.

We’re proud to announce Compound Treasury, designed for businesses and financial institutions to access the benefits of the Compound protocol.

— Compound Labs (@compoundfinance) June 28, 2021

The idea is simple: a fixed 4% APR on US dollars, with daily liquidity and none of the complexity of crypto.https://t.co/l8ih8IzrHh

How is Aave Arc different from Compound Treasury?

With offering a stable 4% yield and allowing institutions to deposit just US Dollar, Compound Treasury is trying to attract different set of Institutional investors than Aave Arc. Compound Treasury investors likely does not need to have much skin in the game as they deposit US Dollar but not crypto currencies. Also there is no variability in the yields as Compound Labs absorbs the fluctionals.

On the other hand Aave Arc is better positioned to allow TradeFi Institutions access DeFi with a lot of skin in the game. Institutions hold crypto currencies in their managed wallets and also lend & borrow cryptocurrencies. Also Investment decisions liking amount of money supplied vs borrowed by Institutions directly influence the yields on Aave Arc Liquidity pools.

Aave Arc is a true gateway for TradeFi Institutions to explore Defi world!