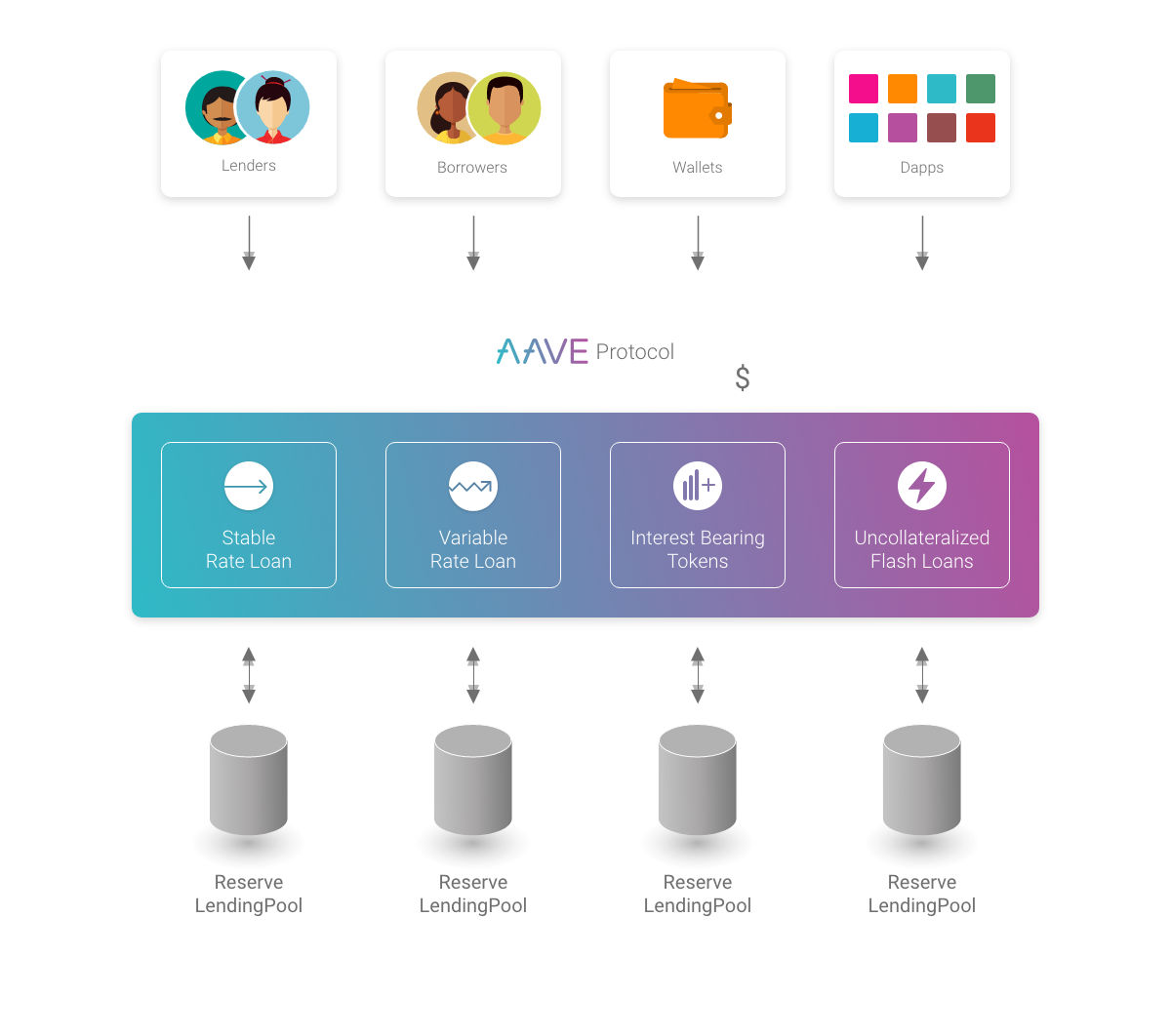

Aave is a decentralized finance(DeFi) application built on Ethereum blockchain with lenders & borrowers are the main participants of the ecosystem. Lenders provide liquidity to the market (Lending Pools) to earn a passive income, while Borrowers are able to borrow from the Lending Pools by depositing an over collateralized asset or using Flash Loans. Here is a high level overview diagram of Aave protocol.

How Lending Pools Earn Fees? Borrow APY + Flash Loan Fees!

Aave’s interest rate model decide how much interest Borrowers should pay when borrowing from Lending Pools. The interest paid by borrowers goes to the Lending Pool and it is distributed to all Lenders of the pool in proportion to the amount of tokens they contributed to the pool. Borrower pay interest for borrowing against their collateral as well as for Flash Loans they can take without any collateral. Flash Loans attract 0.09% interest where as collateralized loans attract interest rate identified by a sophisticated model. Here is the formula used to calculate Lending Pools APY and you can read in-depth about it over here.

Top 5 Lending Pools Earing Fees

Here is the list of best 5 pools earning fees in the past few months.

This animation shows how best 5 pools changed over time. Click on the play icon you see top right corner to start the animation.

Observations

From the charts above you see that USDC Lending Pool is consistently leading as the top pool earning fees. It is followed by its peer stable coins USDT & DAI. Most of the week ETH is fighting for 4th spot with good amount of success. But at times conceding 4th place to TUSD, YFI, BUSD. The 5th spot is always up for grabs and a variety of crypto currencies are occupying the spot.