The purpose of this article is to determine whether any LP NFTs positions of Uniswap V3 have been bought, sold, or transferred between wallets? Will the NFT also be used in other protocols? And also, Explain how an NFT representing an LP position could be used in another Defi protocol.

What Uniswap V3 NFTs?

On Uniswap v3, liquidity provider (LP) positions are represented by NFTs (ERC-721 tokens), as opposed to fungible ERC-20 tokens on earlier versions. A unique NFT representing your position in the specific pool will be generated based on the pool and the parameters you select on the liquidity providing interface. As the owner of the NFT, you can modify or redeem the position at any time.

Uniswap v3’s NFTs are supported by XML-based vector images based on two-dimensional graphics with animation and interaction functions.

Uniswap V3 provides liquidity, which is thought to be the reason for receiving a NFT, but this is an enormous misconception. Which is not just an item to the user and by receiving this NFT, you will own your deposited funds and have the right to redeem them. If this NFT is subsequently sold or transferred, then your right to redeem previously deposited funds will also be transferred.

LP NFTs are generated automatically, users need to follow some instructions and then the V3 smart contract mints an NFT to represent your funded position and sends it to you.After providing liquidity in V2, you will automatically receive your LP Token, as well.

In the following tweet, we can see what Uniswap V3 LP NFTs look like.

Moreover, we can also see how NFTs are described in greater detail step by step.

- In the video above, we learned “UNI/WETH” is a name of the trading pair

- The fee for each pool is the one “0.3%“

- V3 enables every pair to create at least three pools. Each pool corresponds to a different trading rate, here is the fee rate for the pool. From the Uniswap V3 Governance they are like ,

- A stablecoin pool like DAI/USDC could achieve 0.05%,

- A non-correlated pool like ETH/DAI could achieve 0.30%

- For non-correlated exotic pairs could achieve 1.00%.

- Per-pool, governance can enable protocol fees and set them between 10% and 25% of LP fees.

- V3 enables every pair to create at least three pools. Each pool corresponds to a different trading rate, here is the fee rate for the pool. From the Uniswap V3 Governance they are like ,

- Considering the curve in the above example, the degree of aggregation of LP-provided funds on the original constant product curve looks like this. The wider the LP’s funding range and the less aggregated the funding is, the greater the curvature of the curve. The curve can also indicate whether the liquidity you are providing is within the effective range and earning you a return. If the both the end of the curve is a dot, it means the token price is within the effective range. The graph will appear as a ray with a vertex at one end and an extension of infinite length at the other, which indicates that the liquidity deposited is idle and is out of the range .

- The “ID : 1” follows the numbering according to the NFT. The ID visible in the chart is the sequential number each NFT receives at the moment of creation, and the earlier it is created, the smaller the ID value. Additionally, the maximum value of the current ID number allows it to be easily checked how many NFTs have already been created.

- From the above example , “Min Tick : -50580 & Max Tick: -36720” : provides you with the price range of fund allocation. Here, V3 introduced a new concept called tick, which represents a price point on a complete price curve.

- In the right corner, the thumbnail diagram shows where your liquidity is situated in the complete price curve.

- From the above video, “0x149840a85d5afSb£1d1762292Sbdaddc4201£984 . UNI & Oxc02aaa39b223fe8d0a0e5c4127ead90830756cc2 . WETH” , is the address of the token that corresponds to the trading pair. If we click on the card we can see the 2 strings of code that are rotating around the card. Which are the contract addresses of two different tokens in the pool. Here, In order to confirm that you are buying real tokens, you need the contract addresses.

The removal of liquidity can be performed only if you have the NFT in your wallet, which will be burnt along with your liquidity positions. You will receive your tokens at the end of the process. Your position will be refunded 100% if the price stays within the range you specified. If the price does not stay within the range you will be given back both tokens. The NFT represents your ownership of your liquidity position. This is why these NFTs are so precious in the Uniswap V3 and we have to keep them very safe.

Uniswap NFTs Minted and Burnt

In the following graph, we can see which LP NFTs positions of Uniswap V3 have been burned and which have been minted on daily basis. Comparatively, we can see a much higher number of minted NFTs than burnt NFTs. The maximum number of transactions was 2.18K on December 23, 2021

Transferred NFTs

The graph below shows how many ERC721 NFTs are transferred to others on daily basis. A greater number of NFTs were transferred on January 28, 2022. There is an increasing trend in the number of NFTs transferred.

About the Receivers of the Uniswap V3 LP NFTs

On the below graph, you can see the top ten receivers of the Uniswap V3 LP NFTs. Here , Izumi Finance’s address is: 0x01cc44fc1246d17681b325926865cdb6242277a5. It received the largest number of transferred NFTs of all the top 10 recipients. The Liquidbox concept that we discussed above may be attracting more transferees to this.

If we look at the more detailed information about that address we can see it belongs to the “izumi Finance“.

About “izumi Finance”

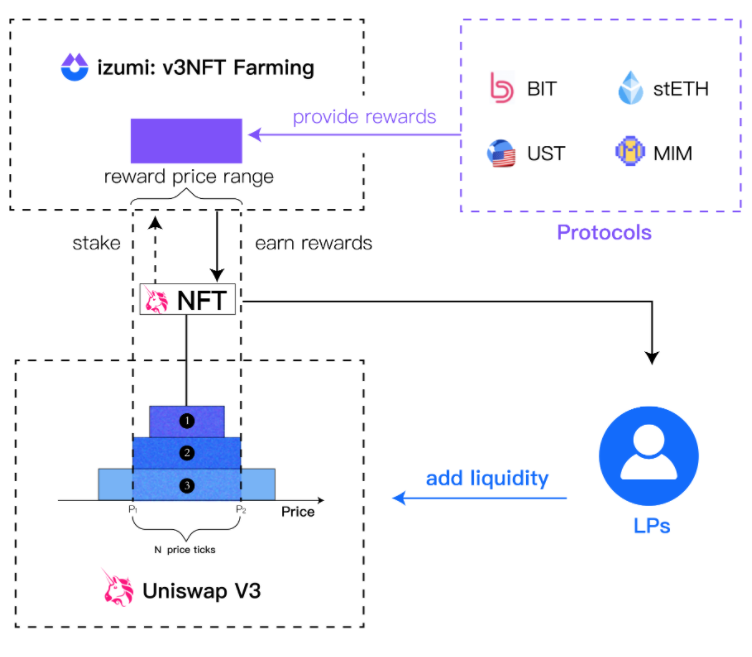

izumi Finance provides Programmable Liquidity as a Service (LaaS) initially on Ethereum, and then will expand to other chains using Uniswap V3. Liquidity providers will earn additional rewards for mining liquidity and trading fees with Uniswap 3. Protocols will gain effective and long-lasting means for attracting liquidity.

LiquidBox: LiquidBox from Izumi Finance comes with programmable liquidity mining (LM) tools, as well as native Uniswap LP and NFT support, Uniswap V3 LP tokens can be staked to earn extra rewards, allowing protocols to provide incentives precisely and efficiently within certain price ranges. Thus, liquidity distribution can be optimized and Uniswap users are encouraged to stake the tokens to earn extra rewards. By setting the value range of the incentivized LP tokens, LiquidBox can design the liquidity mining incentive plan clearly.

The LiquidBox tool will determine automatically if the value range in which the LP tokens are valued is within the boundaries of the liquidity incentive value range specified by the project owner after a staked V3 LP token to izumi protocol. LiquidBox will reward a liquidity provider with a liquidity mining token if they fall within the range.

These incentives attract liquidity providers, and in the same way the pools of BIT, STETH, UST, and MIM, among others, are gaining a lot more liquidity.

For more to discuss about polygon we can consider Pilgrim Protocol.Which is a new project is going to launch on Feb 2022. According to the following tweet we can see that is an upcoming project on Uniswap V3 .

As mentioned in the above tweet, Uniswap V3 will launch Pilgrim protocol soon, which will increase NFT transfers significantly.

Observations

From the above analysis ,

- We can see a maximum number of receivers of the Uniswap V3 LP NFTs are transferred to izumi Finance .It has been suggested that Liquidbox concept we discussed above will attract more receivers to the following address, “0x01cc44fc1246d17681b325926865cdb6242277a5” which belongs to the izumi Finance.

- In addition, Uniswap V3 will launch Pilgrim protocol in the near future, which will significantly increase NFTs transfers.