The new defi app Alchemix is redefining how we borrow money through self-paying loans. Yes, the loans are paid by themselves! On top of self-paying loans, the defi app also makes sure your collateral never liquidates. This may sound anywhere between a hard-to-believe to straight away another fraud defi application!

You will appreciate the brilliance of Alchemix once you understand how it works. Check this Bankless podcast, where the founder of the app explains how the protocol works. Also, check few brilliant teaser videos on its home page https://alchemix.fi for a quick overview.

How to earn 30% ALCX APR + Curve Rewards with your stable coins by providing liquidity on Curve

There are several ways to farm tokens on Alchemix apart from borrowing self-paying loans. Here are a few ways

- Earn 165% of ALCX APR by staking ALCX

- Earn 24% alUSD APR by staking alUSD

- Earn 30% ALCX APR + Curve Rewards by providing liquidity in the form of USDC/DAI/USDT on Curve

Out of all the three options, I tried to farm ALCX tokens by providing liquidity on Curve. Lets go through the steps

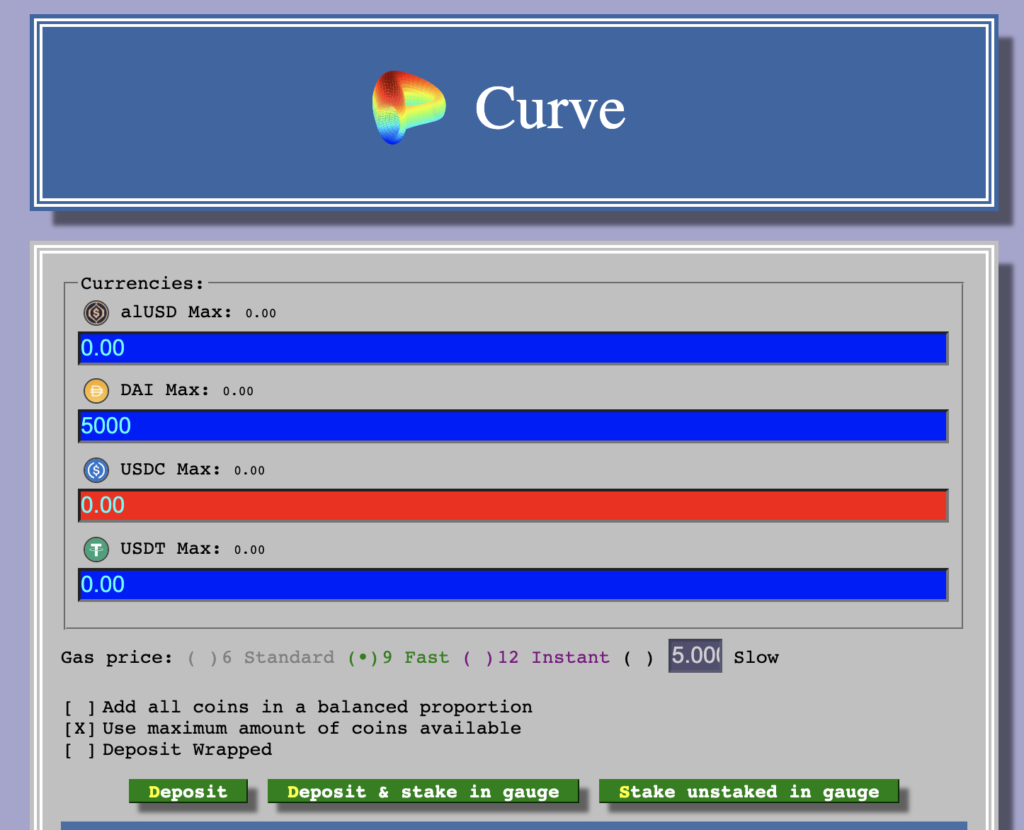

Step 1: Goto alUSD pool on Curve https://curve.fi/alusd/deposit

Step 2: Deposit either one of USDC, USDT, DAI stable coins or in combination depending on what you have in your wallet.

Step 3: Choose the option “Deposit” instead of “Deposit & stake in gauge”

Step 4: You will be prompted to approve transactions on wallet. Pay gas fee and approve transactions required to provide liquidity on Curve.

Once the transactions go through, you will receive alUSD3CRV LP tokens. At this point, you have an option of either getting LP provider fees on Curve or stake these LP tokens on Alchemix to earn 30% ALCX APR. I prefer to stake these tokens for 30% ALCX APR. Continue reading..

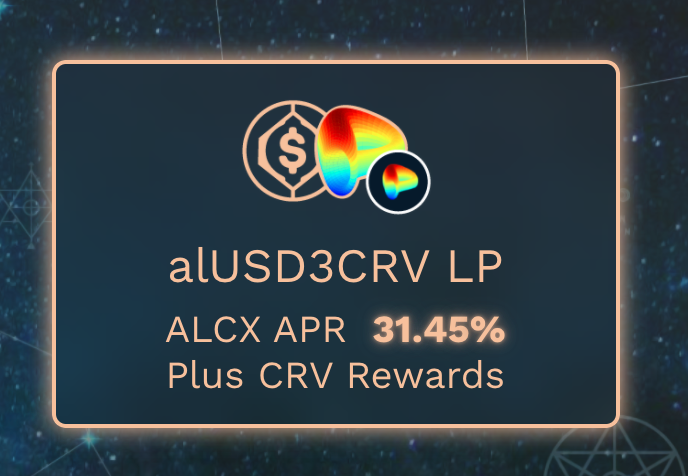

Step 5: Goto Alchemix Farms https://app.alchemix.fi/farms

Step 6: Choose “alUSD3CRV LP” farm

Step 7: Stake your alUSD3CRV LP tokens in exchange for 30% ALCX APR plus additional CRV rewards.

That’s all! You should start seeing accumulation of ALCX & CRV Rewards.

Why not stake alUSD3CRV on yearn.finance or convex?

While exploring farming options I learned that we can stake alUSD3CRV LP tokens on yearn.finance or convex instead of staking them on Alchemix. Here are the reasons why I staked them on Alchemix instead

- yearn.finance offers less returns compared to Alchemix. Though you find high percentage on yearn.finance, please note that yearn.finance numbers are APY while Alchemix are APR. APR is better than APY! You can play with this tool and find the info yourself https://www.aprtoapy.com

- Farming on Convex is recommended by Alchemix and users are expected to get high returns by farming on Convex instead of Alchemix. But I don’t want to take dependency on one more platform and understand risks associated with it. So I decided to stick with Alchemix for farming.

Is ALCX 30% APR fixed?

Just like every other farming opportunity, the ALCX APR is dynamic and volatile. The APR depends on several factors and it keeps fluctuating up & down all the time. By the time you read this post ALCX APR on Alchemix farms may be less than 30% or more than 30%.

Are there any risks in ALCX farming using stable coins?

Everything in Crypto is highly risky and potentially offers high rewards. ALCX farming is no exception. On top here are few other risks I noticed while exploring Alchemix

- ALCX is not recognized by Uniswap, Metamask. You have to manually import ALCX in several defi apps and wallets as it is still not widely recognized.

- ALCX is not yet listed on any major DEXs like Coinbase, Binance, etc.

- The smart contract is new and it is not yet battle tested like established lending platforms like Aave, Compound, etc.

- Alchemix app depends business model heavily depends on yield farming. If and when yield farming cools down, ALCX is likely going to loose its value significantly.