LIDO is a decentralized staking platform that facilitates entry into staking through its easy-to-use interface. It allows you to stake even a fraction of an ETH token and earn a passive income. This article provides an overview of staking, how Lido makes it easy to participate in staking and well as deep dive of Lido’s ecosystem.

What is Staking?

Staking and mining are two different phenomena related to cryptocurrency that are used for creating new coins and circulating them on the market. In mining, a miner solves computational equations to mine new coins and get rewarded. As part of staking, a staker deposits money into a cryptocurrency wallet to support the security and operation of a blockchain network. In its simplest form, staking is the process of locking cryptocurrencies to receive rewards for holding them.

Staking is a term used to refer to the delegating of a certain number of tokens to the governance model of the blockchain and thus locking them out of circulation for a specified length of time

Nicole DeCicco

What is Lido and what problems does Lido solve?

Ethereum’s transition to proof of stake (PoS) began on December 1st, 2020, with the launch of the Beacon Chain. As a result, holders of Ethereum tokens were able to earn rewards by staking their tokens to protect the Ethereum network. However, staking is not something a typical ETH cryptocurreny holder can do because it requires extensive technical knowledge to make it work. Here are some issues associated with staking ETH tokens.

1. Technical expertise: It is important for a person to have the ability to install and update software all the time so as to stay current with the latest release of the stake module. The failure to run the software due to power outages or other issues results in a loss of rewards and in the worst case, staked Ethereum.

2. No unstaking: Due to the fact that Ethereum 2.0 has not yet been launched and no deadline has been set, once ETH tokens have been staked they cannot be withdrawn until Ethereum 2.0 is launched. Because there is no deadline for Ethereum 2.0 network launch, no one knows when they will be able to withdraw their funds. Probably by the end of 2023, maybe even earlier. All depends on how quickly Ethereum core developers complete the transition from Proof of Work to Proof of Stake.

3. ETH Token requirements: In order to serve as a validator and stake tokens, one must have ETH tokens worth 32 ETH. At today’s ETH price it is more than 100,000 USD investment one must make to start earning staking rewards.

Lido tackles all these problems head on and solves them elegantly. With LIDO, anyone can stake ETH tokens even if they only have a fraction of them. Lido’s liquid staking solution for Ethereum is backed by the biggest providers.

How Big is Lido Finance? Bigger than Uniswap!

As a reputable and reliable provider of staking services, Lido is backed by the most prominent staking providers across several blockchains. In total, they manage tokens worth close to 7.2 billion dollars spread over three major blockchains – Ethereum, Terra, and Solana. At 7.2 billion dollars locked in Lido, it is bigger than Uniswap which has 6.6 billion dollars locked as TVL according Defi Pulse.

This graph shows how much money was staked through LIDO through all three blockchains.

Based on information from https://lido.fi, the chart was created on Oct 10. As you can see in the chart, Lido network users trusted them with 4.6 billion dollars in ETH and 2.24 billion dollars in Terra (LUNA). One of the fastest growing offering is the newly launched Solana staking service, which has attracted 154 million dollars so far.

Here are the list of leading Ethereum Node Operators running Lido’s ETH Staking service

- Allnodes Eth

- Figment Eth

- RockX Eth

- Blockdaemon Eth

- Anyblocks Analytics Eth

- Everstake ETH

- DSRV ETH

- Blockscape ETH

- Skillz ETH

- P2P ETH

- Stake.fish ETH

- Chorus One ETH

- Certus One ETH

- Staking Facilities ETH

The chart below shows the distribution of validators staking ETH on Ethereum 2.0’s proof-of-stake network. Lido controls an impressive 9.6% of the total ETH stake in Ethereum. In terms of the number of ETH staked in the Ethereum network, it is ahead of Coinbase, Binance, Stakefish, and many others. About 48% of ETH is held by unknown users, who must be running their own nodes or not registered as a business entity. 29% of the ETH stake is held through centralized exchanges like Coinbase, Gemini, Kraken, Binance and so on.

How Lido Works?

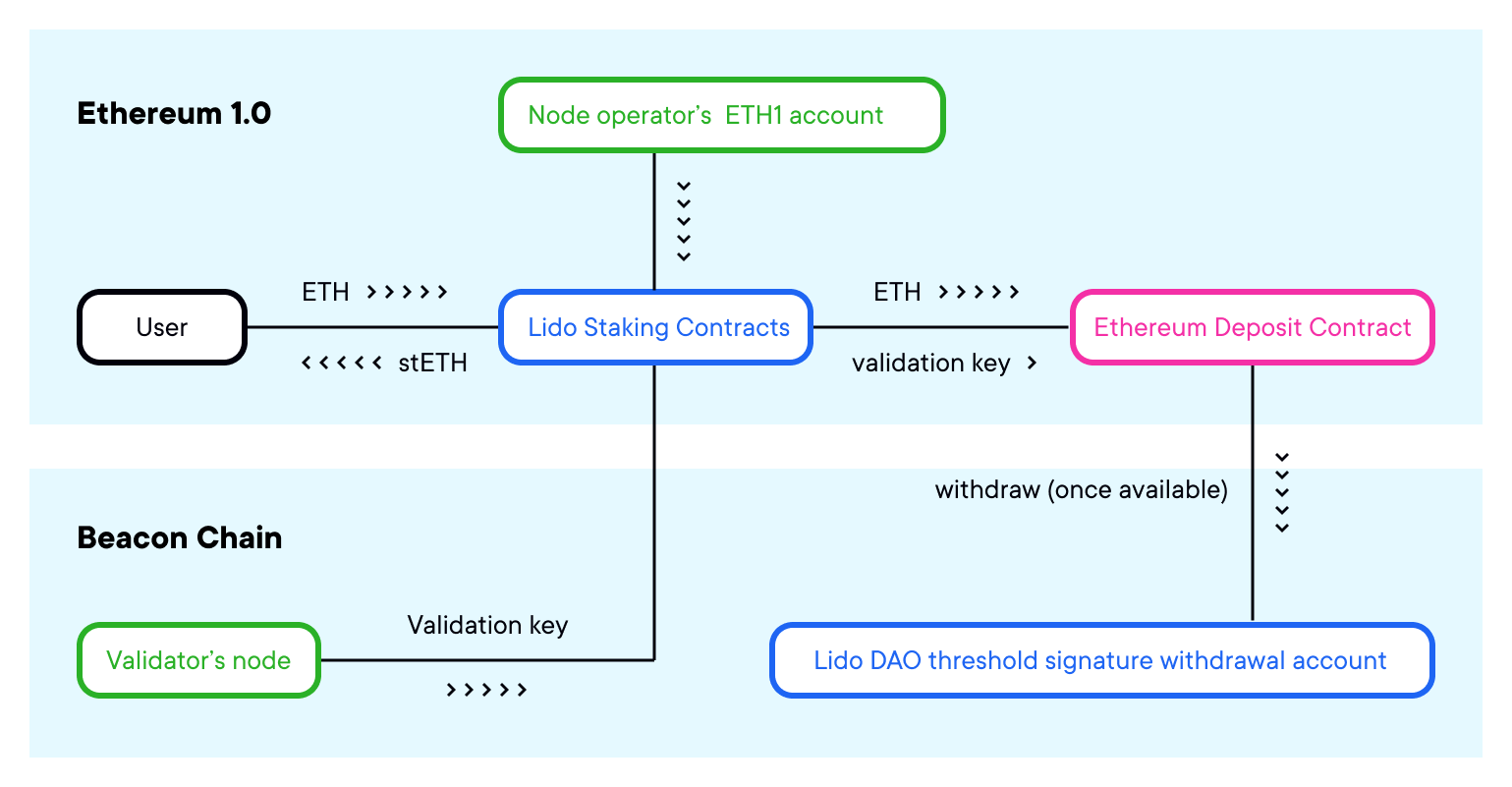

In essence, Lido is an Ethereum smart contract that allows ETH holders with less than 32 ETH to pool their funds and earn rewards. Pooled funds are distributed among selected operators of Ethereum validators that are required for staking operations.

Lido also solves the liquidity problem of ETH stakers by issuing a special ERC20 token, stETH, at a 1:1 ratio when users deposit their ETH for staking. StETH tokens can be traded, transferred, and used in major Defi protocols, just like ETH. If a user wishes to unstake their ETH, they can sell stETH on Curve for ETH and use it however pleases them.

In the current model, 90% of the earnings are credited to ETH stakers, and 10% to the LIDO DAO. The 10% of LIDO DAO share is split 50/50 between node operators and slashing insurance providers.

Tokenized staking ETH is interesting, because you can use the tokenized staked ETH as collateral (for example in Aave) and get more liquidity in ETH so you can leverage quite a lot in Eth 2.0 staking, I’m curious to see how much leverage there will be in staking.

Stani Kulechov, Aave Founder via CoinDesk

What is stETH?

stETH is a Lido token that represents staked ether combined with an initial deposit and stake rewards. When you deposit, stETH tokens are minted and burned when redeemed. It is an ERC20 standard token and its value is pegged at 1:1 with ETH.

The amount of stETH owned by a user is updated every day at 12PM UTC to reflect the staking rewards earned through a process called Continuous Rebasing, which works with Curve & Yearn. Whenever tokens are held anywhere else, continuous rebasing does not take place.

Lido offers liquidity to the staked ETH through stETH. You can therefore use the stETH that you receive in return for staking your ETH with LIDO across all major Defi applications. The sETH can be deposited as collateral on lending platforms, in liquidity pools to earn fees for AMM participation, or traded to other cryptocurrencies using distributed exchanges.

Lido Ecosystem Deep Dive With Charts

We will start our analysis of Lido ecosystem with a chart showing the number of ETH tokens staked through the liquid staking protocol. A total of 1.34 million ETH tokens are staked since Lido is launched. Also you can observe a maximum 191.52K staked during week 41, 2021 (08/20/2021-08/22/2021).

This chart shows the growth of ETH stakers on Lido Finance. As you notice on the chart the rate at which new users are onboarding on to Lido is very impressive.

Lido is growing at an impressive rate, but why? Referrals & bLuna Launch!

Lido’s user base has grown rapidly, but what drives this growth? On this chart, you can see how much Ethereum has been staked through referral programs in comparison to organic (non-referral) programs. Starting in July, the amount of token staked through referrals began to increase significantly and by mid-Sept 2021, it reached a level that eclipsed that of the ETH staked through an organic program. As I write this article, LIDO has acquired 51% of its tokens through the referral program.

Here is another view of chart that shows 51% of ETH staked in LIDO is acquired through referral programs where as other 49% is acquired through organic(non-referral) program.

The graph below shows the amount of ETH acquired by LIDO through Referral versus Organic. Almost 99% of the ETH staked in Lido in March and April of 2021 was obtained through non-referral programs, but that flipped completely by September of 2021. About 92% of the ETH staked in LIDO from Sep 5th to 11th 2021 came from referrals.

Another reason why LIDO is on impressive growth is the launch of bLuna as a collateral on Anchor. With this new feature, stETH can be transformed to bLuna and used a collateral to borrow UST on Terra Anchor protocol

How Much Referral Rewards Are Paid ?

As you see above, Referrals are driving the hyper growth in Lido protocol. Lido incentivizes its community members to bring their family & friends to stake with LIDO and earn LDO tokens as rewards. In order to receive referral rewards, one must deposit a minimum of 1 ETH and the rewards structure is as outlined below

A referral receives 1% payback in LDO of the ETH staked with their referral link. Referral reward amount in LDO is calculated each payout week based on ETH/USD and LDO/USD 14 days (whole referral period) TWAP to be 1% payback. The minimum reward amount is 5 LDO and the maximum reward amount is 20 LDO per 1 ETH staked.

Lido Official Referrals Page

While searching for this information, I was able to locate a partial dataset published by Lido’s team on their notion page. Here is a graph charted out using the information extracted from that page.

A total of 6.13 million LDO tokens were paid between August 2, 2021 to September 27, 2021 as referral incentives. The follow chart shows much of those 6.3 million LDO tokens were distributed among the top 10 Referrers.

Forecasting Staked ETH on Lido

Using a Predictive Analytics, a scientific method that uses past data & statistical algorithms, we can forecast future growth of LIDO and the amount of ETH staked through its services. Here is a prediction of amount of ETH added in next 5 months to LIDO with 70% confidence.

Conclusion

Lido is doing everything right – offers superior staking services through simplified user interface, provides liquidity to staked ETH, collects competitive fees, gives out generous referral rewards and backed by great industry leaders. Lido is on track to be “The winner takes it all” in ETH staking ecosystem.

Pingback: stETH Stats, Volume 4: The Present and Future of stETH - On the Flipside