With the recent strict guidelines imposed by RBI it is mandatory to have PAN card for everyone who wish to take part of banking transactions in India. Even elders should have a PAN card. If we don’t have a PAN card the number of problems we face are too many – you can not deposit more than 50 thousand rupees into a bank account, your Fixed Deposit interests attract flat 30% taxes, etc.

With the recent strict guidelines imposed by RBI it is mandatory to have PAN card for everyone who wish to take part of banking transactions in India. Even elders should have a PAN card. If we don’t have a PAN card the number of problems we face are too many – you can not deposit more than 50 thousand rupees into a bank account, your Fixed Deposit interests attract flat 30% taxes, etc.

If you don’t have a PAN card here is our guide on applying for PAN card in two ways – the first one is traditional offline application where you go to PAN office and the second way is to apply. In this post we will explain how to apply for PAN card online as well as offline.

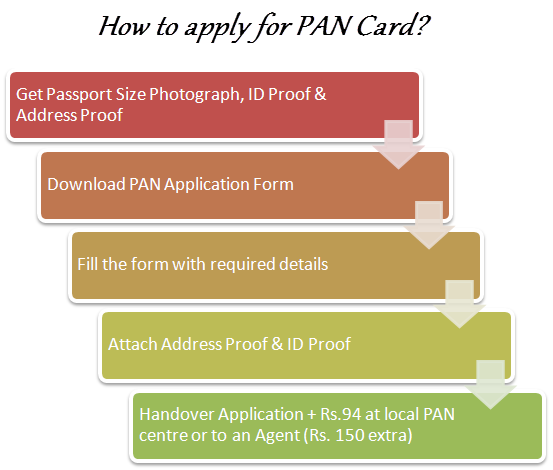

Applying For PAN Card By Submitting Documents At Local PAN Office

This is a traditional way of getting PAN card by filling a physical document, attaching the required proofs and submitting all the required things at a nearest PAN Services office or an Agent. Here is detailed guide on how to apply for PAN card offline

1. Make sure you have a passport size photograph, address proof and ID proof photocopies. You can use Passport and Voter ID as your ID proof and Address proof can be any one of the following documents – Passport, Bank Account Statement(6 months should be fine) or an Address Proof Letter from your Employer, Telephone Bills (landline or postpiad), Electricity bill.

2. Once you have all these documents, download the PAN Application form(http://www.incometaxindia.gov.in/archive/form49ae.pdf) and print it

3. Fill the document with appropriate details using a BLACK BALL POINT PEN. For some reason BLUE PEN is not allowed. If you have any doubts you can refer the guides document available over here https://tin.tin.nsdl.com/pan/Instructions49A.html

4. Affix your photograph & sign in the box available below the photograph

5. Attach photocopies of your address proof and ID proof

6. Submit these documents at the nearest PAN Services office along with the fee of Rs.94. If you don’t have time to go to nearest PAN Services office and track the status if something goes wrong, seek help of an Agent to get things done for you. Agents generally charge between Rs 250 – Rs 300 towards their services charges and PAN application fee.

7. That’s all. You should get your PAN in 15 – 30 days time in a courier/post to the address you specified in the application.

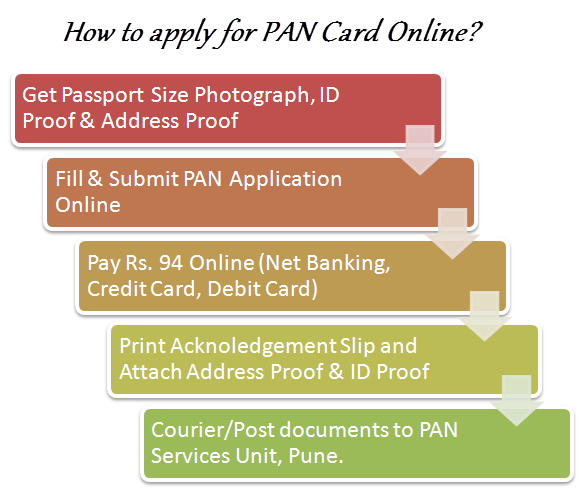

Applying For PAN Card Online

The Government of India now lets you apply PAN card online so that you can save time as well as avoid Agents. Applying for PAN card online is very simple – enter your details in an online form, pay application fee through net banking/debit cards/credit cards, print the acknowledgement form, attach required address proof & id proof and couriers these documents to PAN Service office. Here is the detailed guide

1. Make sure you have a passport size photograph and photo copies of address proof and ID. You can use Passport and Voter ID as your ID proof and Address proof can be any one of the following documents – Passport, Bank Account Statement(6 months should be fine) or an Address Proof Letter from your Employer, Telephone Bills (landline or post-paid mobile), Electricity bill.

2. Go to link https://tin.tin.nsdl.com/pan/index.html and click on the button “New Pan".

3. Follow the on screen instructions and fill the required details. If you have any doubts while filling the form you can refer to online filling guidelines(https://tin.tin.nsdl.com/pan/Guidelines49A.html) and instructions (https://tin.tin.nsdl.com/pan/Instructions49A.html)

4. While filling the form you can choose the pay the fee from any of the online payment options like net banking, credit/debit card or cheque/demand-draft mode so that you can send them in post.

5. Once you submit the document and pay the necessary fee for the application, you will be presented with a acknowledgment slip.

6. Take printout the acknowledgement slip, affix your photograph and duly sign it.

7. Attach address proof, ID proof to the acknowledgment form and super scribe the envelope with ‘APPLICATION FOR PAN – Acknowledgment Number’ (e.g. ‘APPLICATION FOR PAN – 881010100000097’).

8. Courier/post the envelope to PAN Service office at the following address: ‘Income Tax PAN Services Unit, National Securities Depository Limited, 3rd floor, Sapphire Chambers, Near Baner Telephone Exchange, Baner, Pune – 411045‘

9. That’s all. You should get your PAN in 15 – 30 days time in a courier/post to the address you specified in the application.