ParaSwap, one of the most popular distributed exchange aggregators, recently introduced its governance token PSP and airdropped them to 20,000 eligible Ethereum wallets. There was quite a stir about this airdrop both in the ParaSwap community as well as in entire crypto industry for choosing a novel approach in identifying Airdrop eligible accounts. While some praised the novel approach as a game changer, several users took to Twitter to criticize it as rigged and called for a boycott. Here, we’re going to look at ParaSwap Airdrop and see if it’s a game changer or if it is losing users.

Table of Contents

What is Paraswap? The Expedia of Distributed Token Exchanges!

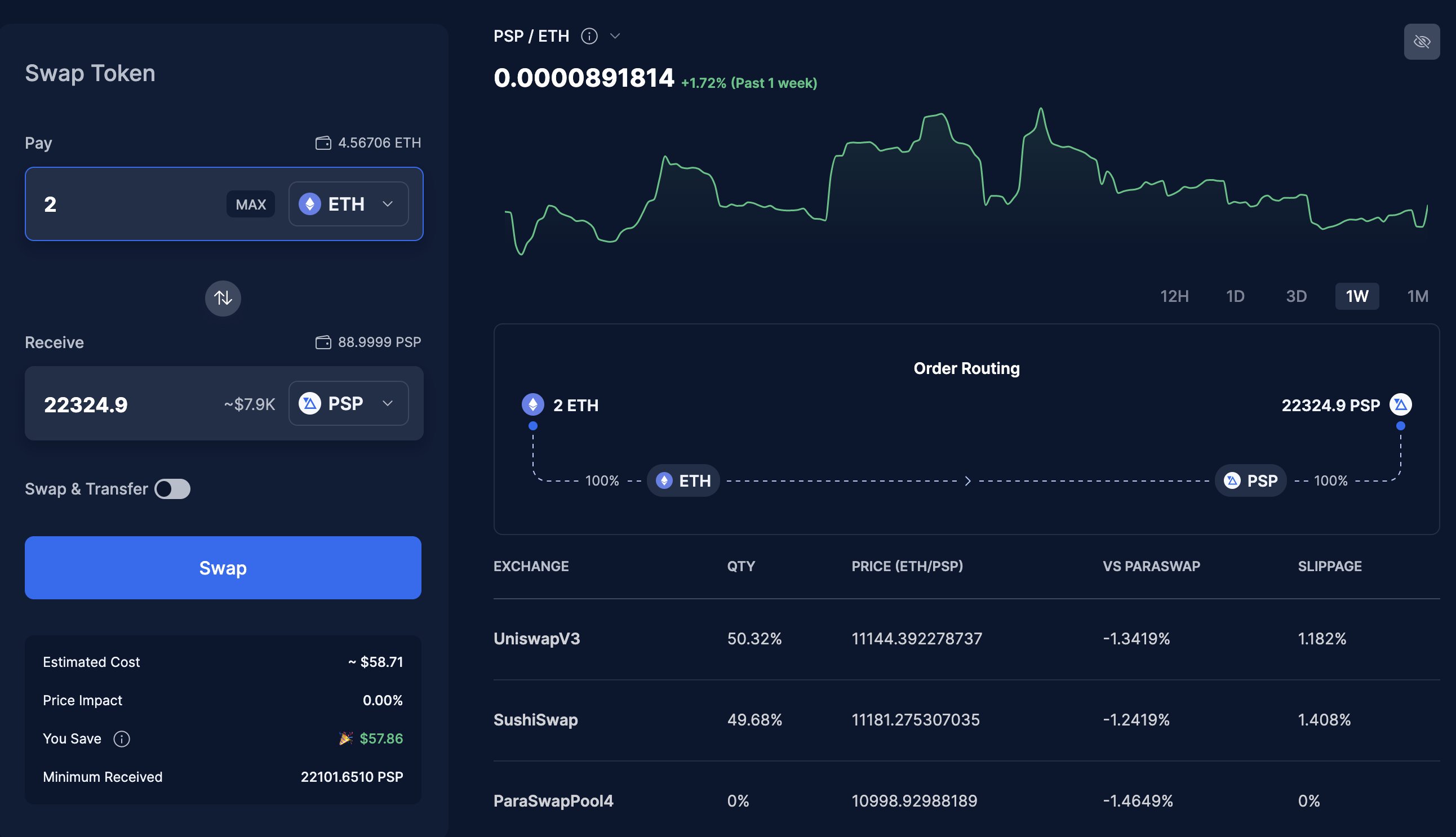

ParaSwap is the Expedia for crypto users who wants to exchange their tokens. Just like the way, how Expedia scans through hundreds of airlines, aggregates and finds best air ticket for your journey, ParaSwap scans through dozens of distributed exchanges like Uniswap, Sushiswap and AMMs like Aave to find best way to exchange crypto tokens.

ParaSwap was created with an aim to provide the following features:

- Exchange on the go – With just one click you can convert your tokens into any other token shown in the app.

- Best rates available – ParaSwap aggregates best rates from different exchanges and provides users with the best possible exchange rate.

- Guaranteed exchange rates – Similar to Centralized Exchanges, ParaSwap guarantees token exchange rates (except for slippages) using a novel architecture of combining pricing information from Centralized Exchanges as well as custom AMM infrastructure.

- Automatic Transfers – With Automatic Transfers you don’t have to worry about transferring to another account. As soon as the tokens are converted they can be transferred to another account.

In the above diagram, you see how various pieces of crypto puzzles fit together in the context of Distributed Exchange Aggregators like ParaSwap. On the bottom, we have blockchains like Ethereum which are the main layers. The layer on top of blockchains is made up of crypto currencies such as USDC, DAI, USDT, ENS, CRV, etc. In order for cryptocurrency token holders to exchange one kind of their tokens for another, they will use Distributed Exchanges (DEXs), such as Uniswap, Sushiswap, Curve, etc. As you can see, this is the third layer in the diagram.

With the emergence of dozens of DEXs these days and each of them having their own strengths and weaknesses, it is not always easy for users to determine which DEX to use to get the best rates when exchanging tokens. As a DEX Aggregator, ParaSwap can assist users in finding the best DEX exchange to exchange their tokens with its DEX Aggregation technology. ParaSwap also splits transactions when users are trying to exchange large amounts of tokens and routes them between different liquidity pools in order to reduce the likelihood of slippage. When users swap large amounts of tokens, users typically gain 1% to 3% depending on the token pairs they are exchanging.

The following picture shows ParaSwap routing ETH to PSP token swap across three different DEXs/Pools for better exchange rates.

Let us Talk About Airdrops

Cryptocurrency airdrops are promotional tools that allow startups to reach a wider audience, by giving away tokens to loyal users. The idea is similar to the concept of an IPO (Initial Public Offering), but the coins are given away instead of sold. This is done to spread awareness about the the project and increase ownership of the new coin by providing incentives for potential investors.

The redemption process for airdropped tokens varies from one crypto application to another. There are some apps where the airdropped tokens are automatically deposited into the users’ wallets, which means that users do not have to do anything to receive the tokens. Alternatively, in many cases, users will have to take the initiative to claim the free tokens by following the instructions provided by the project.

Airdrop Hunting & Sybil Attacks

Airdrops can be very lucrative and highly rewarding. There are some popular airdrops that gave away money in four to five digit figures in US Dollars. Uniswap airdropped 400 UNI tokens to all users who ever performed at least one transaction on its platform, and it was worth 1200$. ENS, the Ethereum blockchain’s utility service, recently gave away 4000$ worth of tokens. As well as DYDX airdropped tokens ranging from 10,000$ to 90,000$.

Due to the lucrative nature of airdrops, a new breed of crypto-users is emerging whose sole job is to maintain dozens of wallets and interact with potential apps which airdrop tokens. It is quite common for them to acquire a small amount of money from their primary wallet and to distribute it across dozens of their secondary wallets for the purpose of conducting just one or two transactions. In this way, both their primary account and all secondary accounts will be eligible for Airdrops, which will bring them a lot of money. This is known as Sybil Attack.

A Sybil attack is a type of attack on a computer network service in which an attacker subverts the service’s reputation system by creating a large number of pseudonymous identities and uses them to gain a disproportionately large influence. It is named after the subject of the book Sybil, a case study of a woman diagnosed with dissociative identity disorder. The name was suggested in or before 2002 by Brian Zill at Microsoft Research. The term pseudospoofing had previously been coined by L. Detweiler on the Cypherpunks mailing list and used in the literature on peer-to-peer systems for the same class of attacks prior to 2002, but this term did not gain as much influence as “Sybil attack”

Wikipedia

Token Dumping

The token dump is another problem faced by crypto startups when airdropping tokens. While airdrops are supposed to jumpstart long-term growth, they do exactly the opposite once the Airdrop hunters dump the tokens in the market as soon as they get hold of them. As quickly as possible, the airdropped tokens are converted into fiat currency by the whales and sybil attackers. The result is steep drops in token prices as there is great selling pressure in the markets. In many cases, a significant drop in token price demoralizes loyal users of the application along with its core developers who work hard to build the system.

ParaSwap’s Bold Approach To Fight Airdrop Hunters

On November 15, when ParaSwap announced the launch of PSP token airdrop it had approximately 1.4 Million wallets interacting with its application. Everyone who has used ParaSwap in the past rushed to find out if they are eligible for the tokens. However, the majority of them were disappointed to learn they weren’t eligible. Only 20,000 of its 1.4 million users were made eligible for the airdrop. Twitter erupted in anger and some people called the airdrop rigged.

ParaSwap took a bold approach to identify eligible users for Airdrop and apply harsh filters to weed out airdrop hunters.

Pushing Vilfredo Pareto’s 80-20 rule to the extremes. 80-0.015 !

In 1848, Vilfredo Federico Damaso Pareto was born in Italy to parents who had fled to Paris as exiles. Pareto became a civil engineer, sociologist, economist, political scientist, and philosopher through his great work.

According to one of the legends, similar to Newton discovering gravity when an apple fell from a tree, Pareto observed that 20% of the pea plants in his garden produced 80% of the healthy pea pods. This observation led him to investigate and discover that just 20% of Italy’s population owned 80% of its fertile land. Eventually, he continued to apply this theory to various subjects and found that 80% of production typically came from 20% of the companies and famously generalized this theory as 80 – 20 Rule

80% of results will come from just 20% of the actions

When finding eligibility for ParaSwap airdrop tokens, ParaSwap founder and engineering team applied Pareto’s 80-20 rule to the crypto ecosystem and push it to extremes. For non-crypto businesses, the 80-20 rule works because they are not prone to Sybil attacks, since most users are identified through Know Your Customer (KYC) or Know Your Business (KYB). However, most crypto users remain anonymous, and also the cost of Sybil attacks in crypto ecosystem is very low. ParaSwap’s founders took the 80-20 to heart and pushed it to the extreme, applying 80-0.015 rule! In their study, they found that more than 80% of their trading volume came from just 0.015% of legible wallets. As a result, they awarded tokens to only 0.015% of users.

Paraswaps’s Airdrop Eligibility Algorithm – Attacking the Sybil Attackers

When many users and airdrop hunters discovered that they were not eligible for ParaSwap’s airdrop, they vented their anger on social media. In response to the outcry, ParaSwap wrote a blog post explaining how they eliminated airdrop hunters who game the system and identified loyal users who are helping it grow. You can read the whole blog post here.

..we have seen a rise in Airdrop Hunters. These are users who create multiple wallets and perform transactions on a protocol for the sole incentive of getting a future airdrop. These users can be standard DeFi users, sophisticated or power defi users, or even hedge funds.

We were highly alarmed by the recent case with RibbonFinance where an investor exploited $2.5M in airdrop rewards using multiple wallets. Hence, we wanted to come up with a mechanism to filter such scenarios to the best of our ability.

Source: ParaSwap Medium

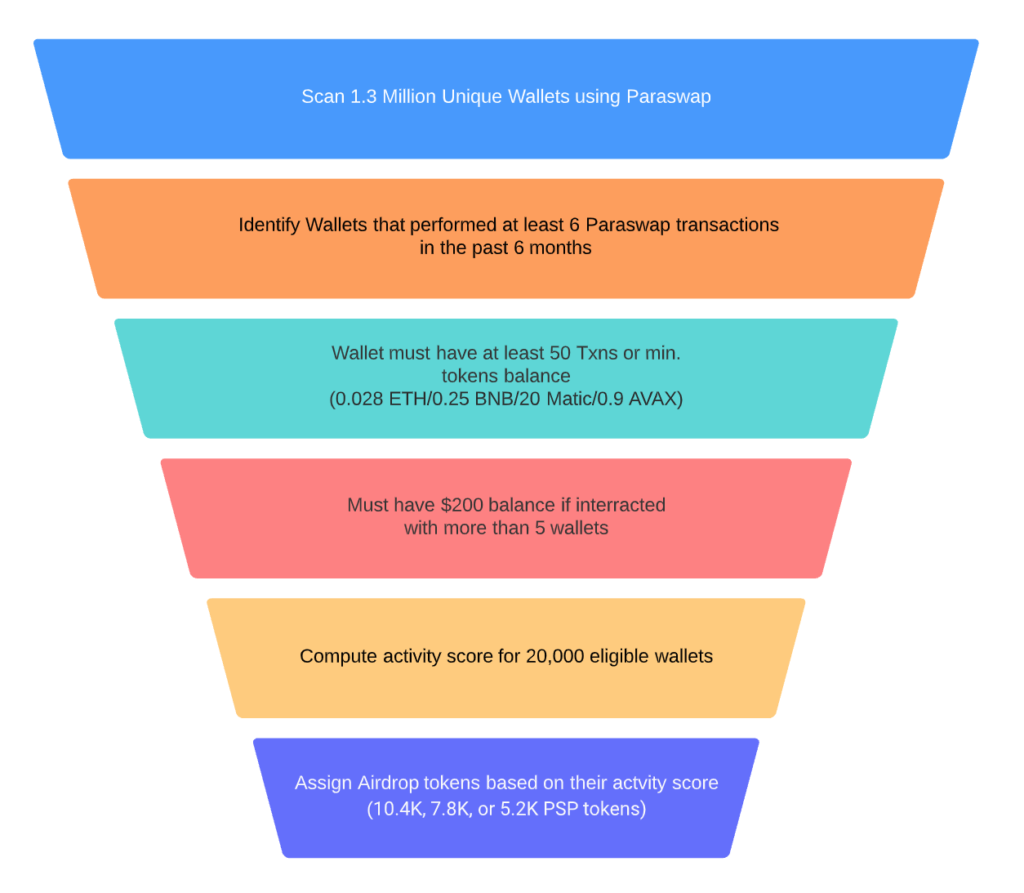

In a simple thread on Twitter, their airdrop eligibility algorithm was explained by the engineer who designed it. Here is a summary of the criteria

- User should have done at least 6 txs on ParaSwap on any network in the last 6 months (before 8th Oct).

- User should either have 50 tx or have a min native token balance (0.028 ETH or 0.25 BNB or 20 Matic or 0.9 AVAX) on the network you used ParaSwap.

- If the user happen to have sent native tokens (ETH, Matic, etc) to other wallets which are also eligible for airdrops and the group of such wallets is bigger than 5 then your wallet should have a portfolio balance (Native Token + known ERC20) greater than $200.

We converted the thread into a diagram that shows how more than 1.4 million wallets that accessed ParaSwap were filtered down to 20,000 airdrop eligible users.

Airdrop Eligible Users

Apart from applying harsh filters on identifying airdrop eligible users, ParaSwap also assigned points to the eligible accounts to allocate number of PSP tokens should be given to them. The formula for assigning points is as below

- If total transaction count > 10 => +1 pt.

- If Max USD value in a single transaction > 100$ => +1 pt, > 1K$ => +2 pts, > 10K$ => +3 pts, > 100K => +4pts.

- If total volume done on ParaSwap > 100$ => +1 pt, > 1K$ => +2 pts, > 10K$ => +3 pts, > 100K => +4pts.

- If used ParaSwap in more than 1 network: +1pt.

Wallets are categorized into one of three buckets according to their score. Anyone with more than 7 points received 10,400 PSP tokens, those with between 3 and 7 points received 7,800 tokens, and the rest of the eligible accounts were given 5,200 tokens. Here is a chart that shows distribution of tokens to airdrop eligible users

Let’s take a look at how many eligible users already claimed their PSP tokens and also how of those who claimed are staking their PSP tokens in the following chart. As we write this post on May 7, around 103.9 million PSP tokens were claimed so far and 63.5 million PSP tokens of them are staked.

Using the PSP token, holders will be able to stake on market makers to increase the impact of their rewards and push the market to deliver more competitive rates. Upon reaching the end of each epoch (14 days) the rewards are split equally between the market makers and the stakers. As ParaSwap is a utility token, airdrop claimers are incentivized to stake them instead of selling them, as they can generate an income. As on May 7th, staking PSP generates returns with 61% of APY.

This chart illustrates that a third of all the claimed tokens were claimed during the first week and then it steadily rose to a sixth of all the claimed tokens during the following week. It is predicted that million of the PSP tokens will be locked in the staking pools of Paraswap if the trend continues.

Did Paraswap alienated it’s loyal users? Not Really!

Many people avoid taking bold steps in favor of following other people’s lead. A common reason why people don’t take bold steps is because they fear criticism. Scientists have found that the brain interprets criticism as a threat, and we are biologically wired to avoid threats. Nobody likes being negatively criticized. Criticism hurts and causes disconnection, triggers shame, and makes us feel inadequate. It is astonishing how many things we refrain from doing consciously or unconsciously because of fear of criticism. ParaSwap however did not simply follow its predecessors, but instead took bold steps. It has come under criticism from its own members who were irritated by the lack of tokens. What are the results of such bold measures? Is ParaSwap thriving with its highly motivated and loyal users, or is there a drop in transactions as users abandon it? We can answer these questions by examining the health metrics – user growth and trading volume.

User Growth : Before and After Airdrop

Growing users is important for any business, whether it is a brick and mortar shop or a cutting edge cryptocurrency smart contract. A bigger audience means greater opportunity for the application to increase its transaction volume and thus its earnings. So how is the new user growth on ParaSwap? The following chart shows the growth of new users before and after the airdrop.

The chart shows a lot of new users interacting with ParaSwap a couple of weeks before the airdrop announcement, but these numbers start dropping drastically afterward. Is it a concern? No, because that’s exactly what ParaSwap is fighting against. Those were Sybil attackers. The theory we have for this phenomenon is that the ParaSwap airdrop was one of the most anticipated airdrops this quarter, and there were rumours circulating on social networks about its arrival. To game the airdrops, these attackers created thousands of wallets and took out their guns. All those attackers left empty handed as soon as the airdrop was announced. So we see a drop in new users after the airdrop announcement.

Customer Retention Is King for any business. Most loyal and best users of don’t just perform one transaction and leave. Their loyalty keeps them coming back for more. They actively contribute to the community and help entrepreneurs improve the product. By doing so, they increase trading volume and revenue. It’d be helpful if we could check the repeat user’s trend before and after the airdrop. The chart below shows a drop in repeat users, but not as drastic as the drop in new users.

Trading Volume : Before and After Airdrop

Considering the permissionless and anonymous nature of crypto users, measuring the health of a decentralized exchange by users is not very accurate. A better way to measure the health of a decentralized exchange is through its trading volume. A trading volume specifies the total amount of trades that occur through the distributed exchange. Let’s compare the trading volume of ParaSwap before and after the airdrop.

Wait a minute! Post airdrop we see declining trading volume. Does not this say that ParaSwap’s users are not happy about the airdrop? Well, trading volumes fluctuate for various reasons. Lets us figure this out.

In order to gain better insights of why we there is a decrease in trading volume of ParaSwap post airdrop, lets us compare it with Uniswap. Comparing ParaSwap trading volume with Uniswap gives us insights if decreased volumes are observed across the board or just in ParaSwap. The chart below shows the trading volume of ParaSwap.

From the charts it is evident that trading volume on Uniswap is also in downtrend since late number and it matches with the trading volume pattern we see in ParaSwap. So this shows that ParaSwap did an excellent job in rewarding the best and most loyal users of it platform.

Final Thoughts

ParaSwap innovated boldly and took on Airdrop Hunters and Sybil Attackers to reward their most loyal users. When any major change disrupts the status quo, we hear a lot of noise, but we hope this analysis provides clear signals. ParaSwap executed its airdrop very well – instead of giving tokens to all users who used it just to test it, they wrote a brilliant algorithm and identified loyal users. ParaSwap distributed fat airdrop tokens to its loyal users instead of spreading thin. It was only possible because the team took bold steps.

Based on the charts and metrics analyzed in the post, we see that ParaSwap users aren’t abandoning the system. The repeat users trend and trading volume forecast are strong.

We believe other crypto applications should follow ParaSwap’s lead and airdrop tokens to only their best and most loyal users. Maybe it’s time for some smart developers out there to productize ParaSwap’s algorithm and open source it.

Reference

- https://en.wikipedia.org/wiki/Pareto_principle

- https://medium.com/paraswap/whats-an-active-user-clarifying-psp-token-distribution-filtering-logic-81df6096d410