Solana, the new kid in the blockchain block, has been praised an Ethereum killer by its supporters and dreaded as a scamcoin by Ethereum Maxis. When a maxi calls something as scamcoin, we should take that very serious if history is teacher. Few years ago, BTC maxis were calling Ethereum as scamcoin but today we know how many use case Ethereum opened up while BTC is staying stagnant and enjoying the digital gold tag.

So when Ethereum maxis call, Solana as scam coin, we should consider Solana as a serious competitor of Ethereum. In this post lets examine various areas and see where Ethereum’s & Solana’s strengths and weakness are.

Ethereum – Proof of Stake

Unlike centralized systems like banks, the Etherum blockchain does not have gatekeepers to verify the transactions. Ethereum 2 relies on a consensus mechanism called “proof of stake” to maintain a chronological record of transactions. On Ethereum blockchain a set of decentralized valdiators who don’t know each other coordinate in validating the transactions and keeping the bad guys away. When a validator is choosen as a leader it generates a block and the rest validates the generated block and atttets them. For generating blocks & attesting, validators are compensated with tokens. If a bad actor(validator) generates a invalid block / attests an invalid block they lose, they are penalized by taking away their staked tokens. This carrots and sticks approach keep the ecosystem fraud resistant.

Solana – Proof of History

The concept of proof of history is based on the fact that accurate timekeeping between computers makes synchronization simple, resulting in high TPS. Ethereum blockchain network rely on validators verifying and agreeing on the order of blocks. However, it is also what makes them slower than other networks.

The proof of history allows validators to keep time in a trustless system. Each validator maintains their own clock and aligns it with their historical record of events, so they can independently agree upon events’ sequence. By doing this, validators do not need to communicate with one another to reach decisions.

Speed / Transactions Per Second

Speed of a blockchain is referred by the number of transactions a blockchain process in a second. The following chart shows the TPS of Solana blockchain, which can process about 3000 TPS at its peak usage. On average Solana processes about 600 transactions per second.

If you are wondering how many transactions Ethereum network can process in a second and where are its charts, let me help you with that. There is no point in plotting Ethereum TPS on a chart next to Solana as you would not be able to see them side by side. The reason for it? Ethereum process max 15 TPS! Yeah, just 15 transactions per second.

If Solana travels at light speed, Ethereum travels like a sloth on a tree. When you compare speed / transactions per second then Solana is a clear winner!

Availability and Reliability

In the past year, I bet you never heard that Ethereum went down even though Ethereum usage has exploded. And in the same duration, I bet you must have heard or read about Solana going down for various reasons. Even a week ago Solana was down as spammers started DDOSing the blockchain through an NFT Minting protocol.

Solana is like early version of Facebook & Twitter – you sneeze the system goes down. You blink the system might have been dealing with another P1 issues. They are in the mode of move fast & break things, just like any startup where they are optimized for speed rather than for stablity.

Today #Solana mainnet-beta went down partially due to botting on the Metaplex Candy Machine program. To combat this, we have merged and will soon deploy a botting penalty to the program as part of a broader effort to stabilize the network. https://t.co/QaAZT3VxXz

— Metaplex (@metaplex) May 1, 2022

If you are looking for a stable blockchain provides 99.999% of stability Solana is not for you. It goes down often and being rebooted countless times by its maintainers. On the other hand Ethereum enjoys the stability like a mountain. No one can hardly disturb the network or attack it. The system down often influences the market cap of spooked investors. Here is a chart of market changes of Solana & Ethereum for comparison.

Active User Base

Strength of any ecosystem is it’s active user base. The following chart shows the daily active users on Ethereum & Solana blockchains. Even though Ethereum enjoys 2-2.5x times more active user bases, Solana has a decent 200K active users using the ecosystem. That is a significant number of users on a new blokchain that too for a blockchain with bad reputation of going down quite often. That charts shows the Solana users love it for all imperfections!

Gas Cost

Can we talk about Etheruem without talking about gas? No way, every one who curses Ethereum must be having gas as a curse word. Ethereum gas prices are horrible and they have gone completely out of control in the past 1 – 2 years. When I say horrible, I literally mean horrible. The recent Yuga Labs (BAYC NFT guys) NFT launch pushed gas prices to insane level with gas around 8000-9000 gwei. NFT minters spent 2,000-3,000$ on gas for a single transaction, while the NFT itself costed less than 500$. The insane gas sent chills through the spines of whales while minions where hiding under the rocks.

The following chart form sol mates twitter shows gas comparison of Solana & Ethereum when the seas are calm and every captain steering the feels like they are the greatest. Even during calm time, it costs 15$ on average to perform a transaction on Ethereum where as it costs less than a cent to perform a transaction on Solana.

The cheap gas price on Solana leaves Etheruem to dust

Decentralization & Censorship Resistant

Blockchains are built as an alternative to centralized systems and banks and their USP is decentralization. No single person or entity can control the system by pointing a gun to head. So if you have measure a blockchain by only one metric then many purist would just use how decentralized the blockchain is.

What impacts how decentralized a network is the number of validator a system has. Solana blockchain has about 1000 validators where as Ethereum blockchain as 300K validators. Ethereum is robust when it comes to decentralization and censorship resistance.

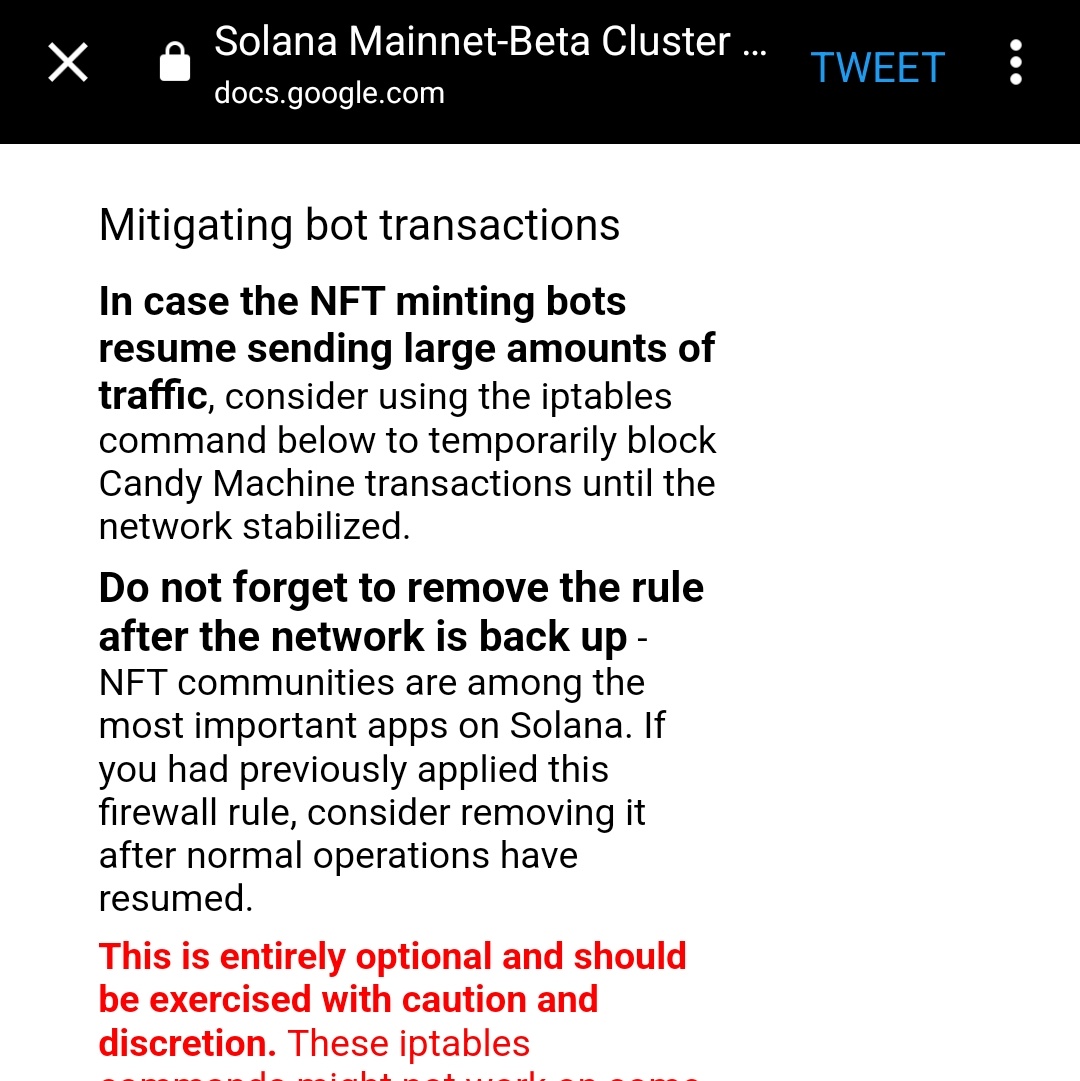

For example, few day ago when a bot network attacked Solana blockchain and took it down, one the measured discussed by Solana core team has alarmed the blockchain community and gave ammunition to ETH maxis to attack Solana users. In a proposal Solana team members explored option of cutting of an NFT minting system that was under attack to stabilize the system. Though this was a proposal, it shook the community as a blockchain ecosystem started exploring censorship to keep its lights on. What if someone points gun to its head? Would not they pull the plug and shut down a wallet / application disliked by an establishment? Very much possible scenario.

First they ignore you, then they laugh at you, then they fight you, then you win.

Solana is going through the same trajectory and attacks like Ethereum few years ago. Ethereum was ridiculed by Bitcoin Maxis (well even today they do that) and they berated in every forum. Ethereum developer never paid attention to any of BTC maxis attacks, instead they kept on building amazing systems – this opened up door for brand new financial and consumer sector’s like Defi, NFTs. Ethereum power billions of dollars worth of decentralized ecosystem now.

Now Ethereum maxis are attacking Solana and taking every chance to throw a shade or attack it publicly. This seems very family to many who have been following the industry. With every attack, Solana is growing stronger, hardening its ecosystem and continue building amazing applications. Lets wait and see where will be Solana by next bull cycle!

The dual problem of @Solana

— DavidHoffman.eth 🔴_🔴 🦇🔊🏴 (@TrustlessState) May 4, 2022

– Goes down, because its fees are too low to prevent spam attacks

– $SOL tokenomics are shit; issuing $8.5m per day, while generating only $53k in fees

The solution for this is so simple:

1. raise fees to prevent spam

2. put revenue into $SOL https://t.co/YN4lSmWb8a